A) Stock A has more market risk than Portfolio AB.

B) Stock A has more market risk than Stock B but less stand-alone risk.

C) Portfolio AB has more money invested in Stock A than in Stock B.

D) Portfolio AB has the same amount of money invested in each of the two stocks.

E) Portfolio AB has more money invested in Stock B than in Stock A.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Porter Inc's stock has an expected return of 13.25%,a beta of 1.25,and is in equilibrium.If the risk-free rate is 2.00%,what is the market risk premium? Do not round your intermediate calculations.

A) 7.11%

B) 8.91%

C) 10.17%

D) 9.00%

E) 7.29%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free rate is 6%;Stock A has a beta of 1.0;Stock B has a beta of 2.0;and the market risk premium,rM - rRF,is positive.Which of the following statements is CORRECT?

A) If the risk-free rate increases but the market risk premium stays unchanged,Stock B's required return will increase by more than Stock A's.

B) Stock B's required rate of return is twice that of Stock A.

C) If Stock A's required return is 11%,then the market risk premium is 5%.

D) If Stock B's required return is 11%,then the market risk premium is 5%.

E) If the risk-free rate remains constant but the market risk premium increases,Stock A's required return will increase by more than Stock B's.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation,recession,and high interest rates are economic events that are best characterized as being

A) systematic risk factors that can be diversified away.

B) company-specific risk factors that can be diversified away.

C) among the factors that are responsible for market risk.

D) risks that are beyond the control of investors and thus should not be considered by security analysts or portfolio managers.

E) irrelevant except to governmental authorities like the Federal Reserve.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.7,whereas Stock B has a beta of 1.3.Portfolio P has 50% invested in both A and B.Which of the following would occur if the market risk premium increased by 1% but the risk-free rate remained constant?

A) The required return on Portfolio P would increase by 1%.

B) The required return on both stocks would increase by 1%.

C) The required return on Portfolio P would remain unchanged.

D) The required return on Stock A would increase by more than 1%,while the return on Stock B would increase by less than 1%.

E) The required return for Stock A would fall,but the required return for Stock B would increase.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An individual stock's diversifiable risk,which is measured by its beta,can be lowered by adding more stocks to the portfolio in which the stock is held.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A stock with a beta equal to -1.0 has zero systematic (or market)risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the coming year,the market risk premium (rM - rRF) ,is expected to fall,while the risk-free rate,rRF,is expected to remain the same.Given this forecast,which of the following statements is CORRECT?

A) The required return will increase for stocks with a beta less than 1.0 and will decrease for stocks with a beta greater than 1.0.

B) The required return on all stocks will remain unchanged.

C) The required return will fall for all stocks,but it will fall more for stocks with higher betas.

D) The required return for all stocks will fall by the same amount.

E) The required return will fall for all stocks,but it will fall less for stocks with higher betas.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for a firm to have a positive beta,even if the correlation between its returns and those of another firm is negative.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cheng Inc.is considering a capital budgeting project that has an expected return of 23% and a standard deviation of 30%.What is the project's coefficient of variation? Do not round your intermediate calculations.Round the final answer to 2 decimal places.

A) 1.60

B) 1.41

C) 1.33

D) 1.30

E) 1.00

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Linke Motors has a beta of 1.30,the T-bill rate is 3.00%,and the T-bond rate is 6.5%.The annual return on the stock market during the past 3 years was 15.00%,but investors expect the annual future stock market return to be 10.75%.Based on the SML,what is the firm's required return? Do not round your intermediate calculations.

A) 12.03%

B) 9.86%

C) 14.43%

D) 14.79%

E) 14.31%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each.The portfolio's beta is 1.12.You plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 2.50.What will the portfolio's new beta be? Do not round your intermediate calculations.

A) 1.032

B) 1.260

C) 1.476

D) 1.200

E) 1.236

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A highly risk-averse investor is considering adding one additional stock to a 3-stock portfolio,to form a 4-stock portfolio.The three stocks currently held all have b = 1.0,and they are perfectly positively correlated with the market.Potential new Stocks A and B both have expected returns of 15%,are in equilibrium,and are equally correlated with the market,with r = 0.75.However,Stock A's standard deviation of returns is 12% versus 8% for Stock B.Which stock should this investor add to his or her portfolio,or does the choice not matter?

A) Either A or B,i.e. ,the investor should be indifferent between the two.

B) Stock A.

C) Stock B.

D) Neither A nor B,as neither has a return sufficient to compensate for risk.

E) Add A,since its beta must be lower.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a portfolio of three randomly selected stocks,which of the following could NOT be true,i.e. ,which statement is false?

A) The riskiness of the portfolio is less than the riskiness of each of the stocks if they were held in isolation.

B) The riskiness of the portfolio is greater than the riskiness of one or two of the stocks.

C) The beta of the portfolio is lower than the lowest of the three betas.

D) The beta of the portfolio is higher than the beta of one or two of the stocks in the portfolio.

E) The beta of the portfolio is calculated as a weighted average of the individual stocks' betas.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roenfeld Corp believes the following probability distribution exists for its stock.What is the coefficient of variation on the company's stock? Do not round your intermediate calculations.

A) 0.4463

B) 0.5775

C) 0.5250

D) 0.5513

E) 0.4725

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks.The portfolio's beta is 1.25.Now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.05.What would the portfolio's new beta be? Do not round your intermediate calculations.

A) 1.11

B) 1.26

C) 1.14

D) 1.24

E) 1.41

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

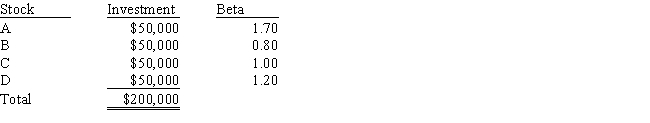

Jim Angel holds a $200,000 portfolio consisting of the following stocks: What is the portfolio's beta? Do not round your intermediate calculations.

A) 1.246

B) 1.434

C) 0.999

D) 1.210

E) 1.175

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

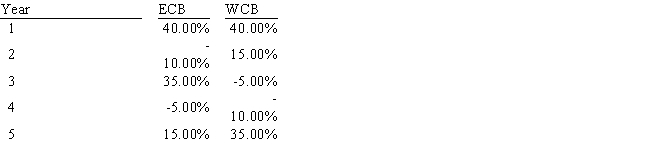

Assume that your uncle holds just one stock,East Coast Bank (ECB) ,which he thinks has very little risk.You agree that the stock is relatively safe,but you want to demonstrate that his risk would be even lower if he were more diversified.You obtain the following returns data for West Coast Bank (WCB) .Both banks have had less variability than most other stocks over the past 5 years.Measured by the standard deviation of returns,by how much would your uncle's risk have been reduced if he had held a portfolio consisting of 57% in ECB and the remainder in WCB? (Hint: Use the sample standard deviation formula. ) Do not round your intermediate calculations.

A) 3.85%

B) 4.87%

C) 3.57%

D) 3.93%

E) 3.06%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8,Stock B has a beta of 1.0,and Stock C has a beta of 1.2.Portfolio P has equal amounts invested in each of the three stocks.Each of the stocks has a standard deviation of 25%.The returns on the three stocks are independent of one another (i.e. ,the correlation coefficients all equal zero) .Assume that there is an increase in the market risk premium,but the risk-free rate remains unchanged.Which of the following statements is CORRECT?

A) The required return of all stocks will remain unchanged since there was no change in their betas.

B) The required return on Stock A will increase by less than the increase in the market risk premium,while the required return on Stock C will increase by more than the increase in the market risk premium.

C) The required return on the average stock will remain unchanged,but the returns of riskier stocks (such as Stock C) will increase while the returns of safer stocks (such as Stock A) will decrease.

D) The required returns on all three stocks will increase by the amount of the increase in the market risk premium.

E) The required return on the average stock will remain unchanged,but the returns on riskier stocks (such as Stock C) will decrease while the returns on safer stocks (such as Stock A) will increase.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The tighter the probability distribution of its expected future returns,the greater the risk of a given investment as measured by its standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 147

Related Exams