A) Credit period.

B) Collection policy.

C) Credit standards.

D) Cash discounts.

E) Payments deferral period.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nogueiras Corp's budgeted monthly sales are $3,000,and they are constant from month to month.40% of its customers pay in the first month and take the 2% discount,while the remaining 60% pay in the month following the sale and do not receive a discount.The firm has no bad debts.Purchases for next month's sales are constant at 50% of projected sales for the next month."Other payments",which include wages,rent,and taxes,are 25% of sales for the current month.Construct a cash budget for a typical month and calculate the average cash gain or loss during the month.Do not round intermediate calculations.

A) $871

B) $632

C) $711

D) $726

E) $617

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Net working capital is defined as current assets divided by current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As a rule,managers should try to always use the free component of trade credit but should use the costly component only if the cost of this credit is lower than the cost of credit from other sources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Van Den Borsh Corp.has annual sales of $61,735,000,an average inventory level of $15,012,000,and average accounts receivable of $10,008,000.The firm's cost of goods sold is 85% of sales.The company makes all purchases on credit and has always paid on the 30th day.However,it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day.The CFO also believes that sales can be maintained at the existing level but inventory can be lowered by $1,946,000 and accounts receivable by $1,946,000.What will be the net change in the cash conversion cycle,assuming a 365-day year? Do not round intermediate calculations.Round to the nearest whole day.

A) -41 days

B) -44 days

C) -28 days

D) -31 days

E) -35 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm that follows an aggressive working capital financing approach uses primarily short-term credit and thus is more exposed to an unexpected increase in interest rates than is a firm that uses long-term capital and thus follows a conservative financing policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dyl Pickle Inc.had credit sales of $5,000,000 last year and its days sales outstanding was DSO = 35 days.What was its average receivables balance,based on a 365-day year.

A) $436,301

B) $426,712

C) $551,370

D) $570,548

E) $479,452

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bumpas Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15,net 50.If the firm chooses to pay on time but does not take the discount,what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year. )

A) 25.56%

B) 23.45%

C) 21.11%

D) 19.47%

E) 22.51%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a profitable firm finds that it simply must "stretch" its accounts payable,then this suggests that it is undercapitalized,i.e. ,that it needs more working capital to support its operations.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although short-term interest rates have historically averaged less than long-term rates,the heavy use of short-term debt is considered to be an aggressive current asset financing strategy because of the inherent risks of using short-term financing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality receipts are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Affleck Inc.'s business is booming,and it needs to raise more capital.The company purchases supplies on terms of 1/10,net 20,and it currently takes the discount.One way of acquiring the needed funds would be to forgo the discount,and the firm's owner believes she could delay payment to 95 days without adverse effects.What would be the effective annual percentage cost of funds raised by this action? (Assume a 365-day year. )

A) 3.66%

B) 5.38%

C) 4.41%

D) 4.23%

E) 3.75%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Long-term loan agreements always contain provisions,or covenants,that constrain the firm's future actions.Short-term credit agreements are just as restrictive in order to protect the interest of the lender.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements concerning the cash budget is CORRECT?

A) Depreciation expense is not explicitly included,but depreciation's effects are reflected in the estimated tax payments.

B) Cash budgets do not include financial items such as interest and dividend payments.

C) Cash budgets do not include cash inflows from long-term sources such as the issuance of bonds.

D) Changes that affect the DSO do not affect the cash budget.

E) Capital budgeting decisions have no effect on the cash budget until projects go into operation and start producing revenues.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

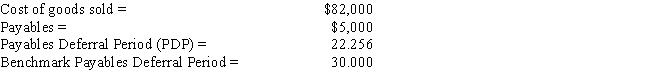

Data on Wentz Inc.for last year are shown below,along with the payables deferral period (PDP) for the firms against which it benchmarks.The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks' average.If this were done,by how much would payables increase? Use a 365-day year.Do not round your intermediate calculations.

A) $2,175

B) $1,618

C) $1,496

D) $1,914

E) $1,740

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,if a firm "stretches" (i.e. ,delays paying)its accounts payable,this will lengthen its cash conversion cycle (CCC).

B) False

Correct Answer

verified

Correct Answer

verified

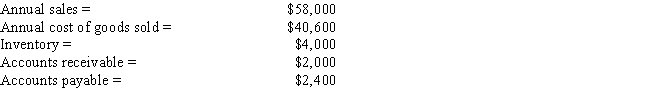

Multiple Choice

Dewey Corporation has the following data,in thousands.Assuming a 365-day year,what is the firm's cash conversion cycle? Do not round intermediate calculations.Round your answer to the nearest day.

A) 22 days

B) 30 days

C) 27 days

D) 20 days

E) 23 days

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in a firm's collection policy can affect sales,working capital,and profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buskirk Construction buys on terms of 2/15,net 60 days.It does not take discounts,and it typically pays on time,60 days after the invoice date.Net purchases amount to $600,000 per year.On average,how much "free" trade credit does the firm receive during the year? (Assume a 365-day year,and note that purchases are net of discounts. )

A) $23,178

B) $26,877

C) $20,466

D) $24,658

E) $18,986

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roton Inc.purchases merchandise on terms of 2/15,net 40,and its gross purchases (i.e. ,purchases before taking off the discount) are $525,000 per year.What is the maximum dollar amount of costly trade credit the firm could get,assuming it abides by the supplier's credit terms? (Assume a 365-day year. ) Do not round intermediate calculations.

A) $36,297

B) $31,011

C) $42,992

D) $31,363

E) $35,240

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 124

Related Exams