A) $42,000

B) $200,000

C) $264,000

D) $464,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The budget procedure that requires all levels of management to start from zero in estimating sales, production, and other operating data is called zero-based budgeting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

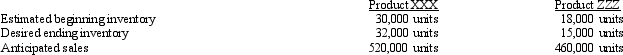

Below is budgeted production and sales information for Bluebird Company for the month of December:  The unit selling price for product XXX is $5 and for product ZZZ is $14.

Budgeted production for product XXX during the month is:

The unit selling price for product XXX is $5 and for product ZZZ is $14.

Budgeted production for product XXX during the month is:

A) 522,000 units

B) 552,000 units

C) 518,000 units

D) 520,000 units

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A variant of fiscal-year budgeting whereby a twelve-month projection into the future is maintained at all times is termed:

A) flexible budgeting

B) continuous budgeting

C) zero-based budgeting

D) master budgeting

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Planning for capital expenditures is necessary for all of the following reasons except:

A) machinery and other fixed assets wear out

B) expansion may be necessary to meet increased demand

C) amounts spent for office equipment may be immaterial

D) fixed assets may fall below minimum standards of efficiency

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

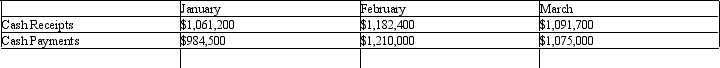

A company is preparing its their Cash Budget. The following data has been provided for cash receipts and payments.  The company's cash balance at January 1st is $290,000. This company desires a minimum cash balance of $340,000.

What is the amount of excess cash or deficiency of cash (after considering the minimum cash balance required) for February?

The company's cash balance at January 1st is $290,000. This company desires a minimum cash balance of $340,000.

What is the amount of excess cash or deficiency of cash (after considering the minimum cash balance required) for February?

A) $109,100 deficiency

B) $10,900 excess

C) $900 deficiency

D) $109,100 excess

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

At the beginning of the period, the Cutting Department budgeted direct labor of $30,000 and supervisor salaries of $20,000 for 3,000 hours of production. The department actually completed 5,000 hours of production. Determine the budget for the department assuming that it uses flexible budgeting?

Correct Answer

verified

Correct Answer

verified

Essay

Magnolia, Inc. manufactures bedding sets. The budgeted production is for 55,000 comforters in 2012. Each comforter requires 7 yards of material. The estimated January 1, 2012, beginning inventory is 31,000 yards. The desired ending balance is 30,000 yards of material. If the material costs $4.00 per yard, determine the materials budget for 2012.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cameron Manufacturing Co.'s static budget at 5,000 units of production includes $40,000 for direct labor and $5,000 for variable electric power. Total fixed costs are $20,000. At 8,000 units of production, a flexible budget would show:

A) variable costs of $64,000 and $25,000 of fixed costs

B) variable costs of $64,000 and $20,000 of fixed costs

C) variable costs of $72,000 and $20,000 of fixed costs

D) variable and fixed costs totaling $104,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be used in preparing a cash budget for October?

A) Beginning cash balance on October 1.

B) Budgeted salaries expense for October.

C) Estimated depreciation expense for October.

D) Budgeted sales and collections for October.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $260,000, $375,000, and $400,000, respectively, for September, October, and November. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections in October from accounts receivable are:

A) $246,400

B) $262,500

C) $210,000

D) $294,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For January, sales revenue is $700,000; sales commissions are 5% of sales; the sales manager's salary is $96,000; advertising expenses are $90,000; shipping expenses total 2% of sales; and miscellaneous selling expenses are $2,100 plus 1/2 of 1% of sales. Total selling expenses for the month of January are:

A) $157,100

B) $240,600

C) $183,750

D) $182,100

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

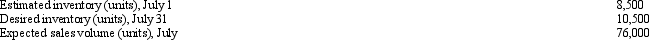

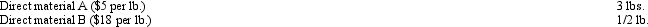

Production estimates for July are as follows:  For each unit produced, the direct materials requirements are as follows:

For each unit produced, the direct materials requirements are as follows:

The total direct materials purchases of materials A and B (assuming no beginning or ending material inventory) required for July production is:

The total direct materials purchases of materials A and B (assuming no beginning or ending material inventory) required for July production is:

A) $1,080,000 for A; $648,000 for B

B) $1,080,000 for A; $1,296,000 for B

C) $1,170,000 for A; $702,000 for B

D) $1,125,000 for A; $675,000 for B

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fashion Jeans, Inc. sells two lines of jeans; Simple Life and Fancy Life. Simple Life sells for $85.00 a pair and Fancy Life sells for $100.00 a pair. The company sells all of its jeans on credit and estimates that 60% is collected in the month of the sale, 35% is collected in the following month, and the rest is considered to be uncollectible. The estimated sales for Simple are as follows: January 20,000 jeans, February 27,500 jeans, and March 25,000 jeans. The estimated sales for Fancy are as follows: January 18,000 jeans, February 19,000, and March 20,500 jeans. What are the expected cash receipts for the month of March?

A) $3,988,125

B) $2,505,000

C) $2,125,000

D) $4,175,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Woodpecker Co. has $296,000 in accounts receivable on January 1. Budgeted sales for January are $860,000. Woodpecker Co. expects to sell 20% of its merchandise for cash. Of the remaining 80% of sales on account, 75% are expected to be collected in the month of sale and the remainder the following month. The January cash collections from sales are:

A) $812,000

B) $688,000

C) $468,000

D) $984,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tanya Inc.'s static budget for 10,000 units of production includes $60,000 for direct materials, $44,000 for direct labor, fixed utilities costs of $5,000, and supervisor salaries of $20,000. A flexible budget for 12,000 units of production would show:

A) the same cost structure in total

B) direct materials of $72,000, direct labor of $52,800, utilities of $5,000, and supervisor salaries of $20,000

C) total variable costs of $154,800

D) direct materials of $60,000, direct labor of $52,800, utilities of $6,000, and supervisor salaries of $20,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgetary unit of an organization which is led by a manager who has both the authority over and responsibility for the unit's performance is known as a:

A) control center

B) budgetary area

C) responsibility center

D) managerial department

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget presents the expected inflow and outflow of cash for a specified period of time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A formal written statement of management's plans for the future, expressed in financial terms, is a:

A) gross profit report

B) responsibility report

C) budget

D) performance report

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

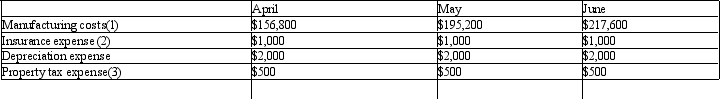

Finch Company began its operations on March 31 of the current year. Finch Co. has the following projected costs:  (1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of the quarter, i.e. January, April, July, and October.

(3) Property tax is paid once a year in November.

The cash payments for Finch Company in the month of April are:

(1) 3/4 of the manufacturing costs are paid for in the month they are incurred. 1/4 is paid in the following month.

(2) Insurance expense is $1,000 a month, however, the insurance is paid four times yearly in the first month of the quarter, i.e. January, April, July, and October.

(3) Property tax is paid once a year in November.

The cash payments for Finch Company in the month of April are:

A) $122,600

B) $120,600

C) $123,100

D) $121,100

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 188

Related Exams