A) 4.73

B) 5.26

C) 5.84

D) 6.42

E) 7.07

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The relative profitability of a firm that employs an aggressive current asset financing policy will improve if the yield curve changes from upward sloping to downward sloping.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The maturity of most bank loans is short term.Bank loans to businesses are frequently made as 90-day notes which are often rolled over, or renewed, rather than repaid when they mature.However, if the borrower's financial situation deteriorates, then the bank may refuse to roll over the loan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

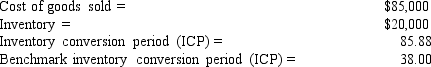

Data on Liu Inc.for the most recent year are shown below, along with the inventory conversion period (ICP) of the firms against which it benchmarks.The firm's new CFO believes that the company could reduce its inventory enough to reduce its ICP to the benchmarks' average.If this were done, by how much would inventories decline? Use a 365-day year.

A) $7, 316

B) $8, 129

C) $9, 032

D) $10, 036

E) $11, 151

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT directly reflected in the cash budget of a firm that is in the zero tax bracket?

A) Depreciation.

B) Cumulative cash.

C) Repurchases of common stock.

D) Payment for plant construction.

E) Payments lags.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions should Reece Windows take if it wants to reduce its cash conversion cycle?

A) Take steps to reduce the DSO.

B) Start paying its bills sooner, which would reduce the average accounts payable but not affect sales.

C) Sell common stock to retire long-term bonds.

D) Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock.

E) Increase average inventory without increasing sales.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

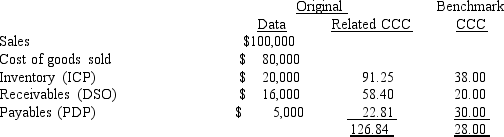

Refer to Exhibit 21.1.What's the difference in the projected ROEs under the restricted and relaxed policies?

A) 1.20%

B) 1.50%

C) 1.80%

D) 2.16%

E) 2.59%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The twin goals of inventory management are (1)to ensure that the inventories needed to sustain operations are available, but (2)to hold the costs of ordering and carrying inventories to the lowest possible level.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Setting up a lockbox arrangement is one way for a firm to speed up the collection of payments from its customers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hinkle Corporation buys on terms of 2/15, net 60 days.It does not take discounts, and it typically pays on time, 60 days after the invoice date.Net purchases amount to $550, 000 per year.On average, what is the dollar amount of total trade credit (costly + free) the firm receives during the year, i.e., what are its average accounts payable? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $90, 411

B) $94, 932

C) $99, 678

D) $104, 662

E) $109, 895

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Net working capital, defined as current assets minus the sum of payables and accruals, is equal to the current ratio minus the quick ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The calculated cost of trade credit for a firm that buys on terms of 2/10 net 30 is lower (other things held constant)if the firm plans to pay in 40 days than in 30 days.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Exhibit 21.1.Assume now that the company believes that if it adopts a restricted policy, its sales will fall by 15% and EBIT will fall by 10%, but its total assets turnover, debt ratio, interest rate, and tax rate will all remain the same.In this situation, what's the difference between the projected ROEs under the restricted and relaxed policies?

A) 2.24%

B) 2.46%

C) 2.70%

D) 2.98%

E) 3.27%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

"Stretching" accounts payable is a widely accepted, entirely ethical, and costless financing technique.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most consistent with efficient inventory management? The firm has a

A) low incidence of production schedule disruptions.

B) below average total assets turnover ratio.

C) relatively high current ratio.

D) relatively low DSO.

E) below average inventory turnover ratio.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

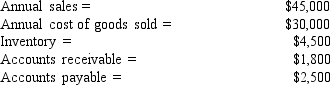

Shulman Inc.has the following data, in thousands.Assuming a 365-day year, what is the firm's cash conversion cycle?

A) 28 days

B) 32 days

C) 35 days

D) 39 days

E) 43 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's peak borrowing needs will probably be overstated if it bases its monthly cash budget on the assumption that both cash receipts and cash payments occur uniformly over the month but in reality payments are concentrated at the beginning of each month.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items should a company report directly in its monthly cash budget?

A) Cash proceeds from selling one of its divisions.

B) Accrued interest on zero coupon bonds that it issued.

C) New shares issued in a stock split.

D) New shares issued in a stock dividend.

E) Its monthly depreciation expense.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fontana Painting had the following data for the most recent year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its NWC and CCC up to the benchmark companies' level without affecting either sales or the costs of goods sold.Fontana finances its net working capital with a bank loan at an 8% annual interest rate, and it uses a 365-day year.If these changes had been made, by how much would the firm's pre-tax income have increased?

A) 1, 901

B) 2, 092

C) 2, 301

D) 2, 531

E) 2, 784

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The company you just started has been offered credit terms of 4/30, net 90 days.What will be the nominal annual percentage cost of its non-free trade credit if it pays 120 days after the purchase? (Assume a 365-day year.)

A) 16.05%

B) 16.90%

C) 17.74%

D) 18.63%

E) 19.56%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 138

Related Exams