B) False

Correct Answer

verified

Correct Answer

verified

True/False

Loans from commercial banks generally appear on balance sheets as notes payable.A bank's importance is actually greater than it appears from the dollar amounts shown on balance sheets because banks provide nonspontaneous funds to firms.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

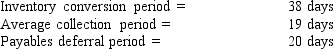

Fireside Inc.has the following data.What is the firm's cash conversion cycle?

A) 33 days

B) 37 days

C) 41 days

D) 45 days

E) 49 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mark's Manufacturing's average age of accounts receivable is 45 days, the average age of accounts payable is 40 days, and the average age of inventory is 69 days.Assuming a 365-day year, what is the length of its cash conversion cycle?

A) 63 days

B) 67 days

C) 70 days

D) 74 days

E) 78 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newsome Inc.buys on terms of 3/15, net 45.It does not take the discount, and it generally pays after 60 days.What is the nominal annual percentage cost of its non-free trade credit, based on a 365-day year?

A) 25.09%

B) 27.59%

C) 30.35%

D) 33.39%

E) 36.73%

G) None of the above

Correct Answer

verified

A

Correct Answer

verified

True/False

The average accounts receivable balance is a function of both the volume of credit sales and the days sales outstanding.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following actions would be likely to shorten the cash conversion cycle?

A) Change the credit terms offered to customers from 3/10 net 30 to 1/10 net 50.

B) Begin to take discounts on inventory purchases; we buy on terms of 2/10 net 30.

C) Adopt a new manufacturing process that saves some labor costs but slows down the conversion of raw materials to finished goods from 10 days to 20 days.

D) Change the credit terms offered to customers from 2/10 net 30 to 1/10 net 60.

E) Adopt a new manufacturing process that speeds up the conversion of raw materials to finished goods from 20 days to 10 days.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carter & Carter is considering setting up a regional lockbox system to speed up collections.The company sells to customers all over the U.S., and all receipts come in to its headquarters in San Francisco.The firm's average accounts receivable balance is $2.5 million, and they are financed by a bank loan at an 11% annual interest rate.The firm believes this new lockbox system would reduce receivables by 20%.If the annual cost of the system is $15, 000, what pre-tax net annual savings would be realized?

A) $29, 160

B) $32, 400

C) $36, 000

D) $40, 000

E) $44, 000

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Changes in a firm's collection policy can affect sales, working capital, and profits.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firms generally choose to finance temporary current operating assets with short-term debt because

A) short-term interest rates have traditionally been more stable than long-term interest rates.

B) a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term.

C) the yield curve is normally downward sloping.

D) short-term debt has a higher cost than equity capital.

E) matching the maturities of assets and liabilities reduces risk under some circumstances, and also because short-term debt is often less expensive than long-term capital.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is NOT CORRECT?

A) Credit policy has an impact on working capital because it influences both sales and the time before receivables are collected.

B) The cash budget is useful to help estimate future financing needs, especially the need for short-term working capital loans.

C) If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60.

D) Managing working capital is important because it influences financing decisions and the firm's profitability.

E) A company may hold a relatively large amount of cash and marketable securities if it is uncertain about its volume of sales, profits, and cash flows during the coming year.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A firm constructing a new manufacturing plant and financing it with short-term loans, which are scheduled to be converted to first mortgage bonds when the plant is completed, would want to separate the construction loan from its current liabilities associated with working capital when calculating net working capital.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Synchronization of cash flows is an important cash management technique, as proper synchronization can reduce the required cash balance and increase a firm's profitability.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Funds from short-term loans can generally be obtained faster than from long-term loans for two reasons: (1)when lenders consider long-term loans they must make a more thorough evaluation of the borrower's financial health, and (2)long-term loan agreements are more complex.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will cause an increase in net working capital, other things held constant?

A) A cash dividend is declared and paid.

B) Merchandise is sold at a profit, but the sale is on credit.

C) Long-term bonds are retired with the proceeds of a preferred stock issue.

D) Missing inventory is written off against retained earnings.

E) Cash is used to buy marketable securities.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT a situation that might lead a firm to increase its holdings of short-term marketable securities?

A) The firm is going from its peak sales season to its slack season, so its receivables and inventories will experience a seasonal decline.

B) The firm is going from its slack season to its peak sales season, so its receivables and inventories will experience seasonal increases.

C) The firm has just sold long-term securities and has not yet invested the proceeds in operating assets.

D) The firm just won a product liability suit one of its customers had brought against it.

E) The firm must make a known future payment, such as paying for a new plant that is under construction.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The concept of permanent current operating assets reflects the fact that some components of current assets do not shrink to zero even when a business is at its seasonal or cyclical low.Thus, permanent current operating assets represent a minimum level of current assets that must be financed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statement completions is CORRECT? If the yield curve is upward sloping, then the marketable securities held in a firm's portfolio, assumed to be held for emergencies, should

A) consist mainly of short-term securities because they pay higher rates.

B) consist mainly of U.S.Treasury securities to minimize interest rate risk.

C) consist mainly of short-term securities to minimize interest rate risk.

D) be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates.

E) consist mainly of long-term securities because they pay higher rates.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pascarella Inc.is revising its payables policy.It has annual sales of $50, 735, 000, an average inventory level of $15, 012, 000, and average accounts receivable of $10, 008, 000.The firm's cost of goods sold is 85% of sales.The company makes all purchases on credit and has always paid on the 30th day.However, it now plans to take full advantage of trade credit and to pay its suppliers on the 40th day.The CFO also believes that sales can be maintained at the existing level but inventory can be lowered by $1, 946, 000 and accounts receivable by $1, 946, 000.What will be the net change in the cash conversion cycle, assuming a 365-day year?

A) -26.6 days

B) -29.5 days

C) -32.8 days

D) -36.4 days

E) -40.5 days

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The longer its customers normally hold inventory, the longer the credit period supplier firms normally offer.Still, suppliers have some flexibility in the credit terms they offer.If a supplier lengthens the credit period offered, this will shorten the customer's cash conversion cycle but lengthen the supplier firm's own CCC.

B) False

Correct Answer

verified

True

Correct Answer

verified

Showing 1 - 20 of 138

Related Exams