Correct Answer

verified

Correct Answer

verified

True/False

The usual presentation of the retained earnings statement is (1) beginning retained earnings, (2) net income or loss, (3) dividends (4) ending retained earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the accounts below would appear in the Balance Sheet columns of the work sheet?

A) Service Revenue

B) Prepaid Rent

C) Supplies Expense

D) None are correct

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Any twelve-month accounting period adopted by a company is known as its fiscal year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amir Designs purchased a one-year liability insurance policy on March 1st of this year for $7,200 and recorded it as a prepaid expense. Which of the following amounts would be recorded for insurance expense during the adjusting process at the end of Amir's first month of operations on March 31st?

A) $7,200

B) $720

C) $600

D) $6,600

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Prepaid insurance is reported on the balance sheet as a

A) current asset

B) fixed asset

C) current liability

D) long-term liability

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

There is really no benefit in preparing financial statements in any particular order.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Journalizing and posting the adjustments and closing entries updates the ledger for the new accounting period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

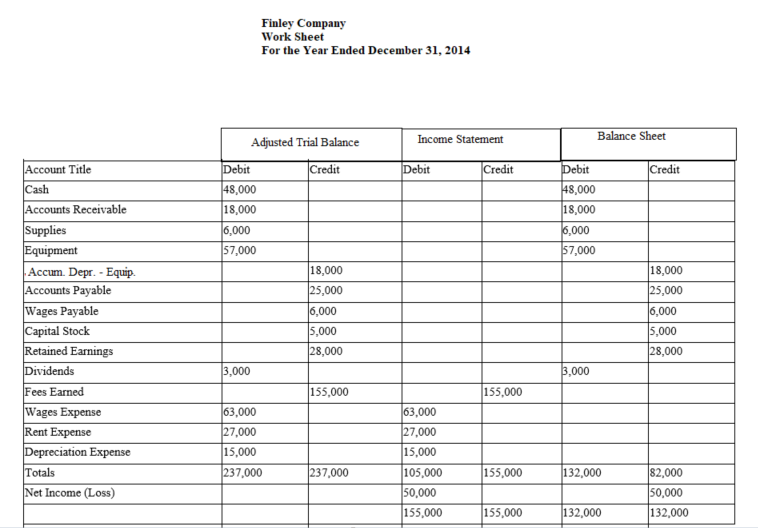

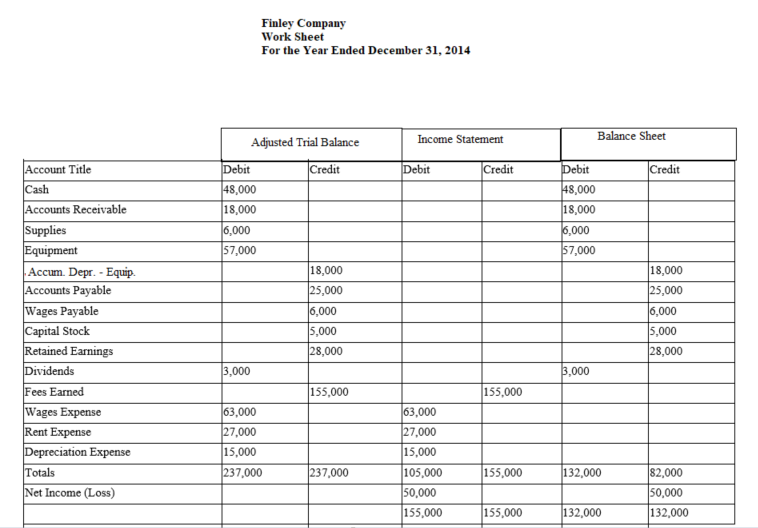

Use the work sheet for Finley Company to answer the questions that follow.  The entry to close Income Summary would be

The entry to close Income Summary would be

A) debit Retained Earnings, $50,000; credit Income Summary, $50,000

B) debit Income Summary, $155,000; credit Retained Earnings, $155,000

C) debit Income Summary, $50,000; credit Retained Earnings, $50,000

D) debit Retained Earnings, $9,000; credit Income Summary, $9,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which item would appear in the Income Statement columns of the work sheet?

A) Equipment

B) Unearned Fees

C) Prepaid Expense

D) Net Loss

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the work sheet for Finley Company to answer the questions that follow.  The entry to close expenses would be

The entry to close expenses would be

A) Wages Expense 63,000 Rent Expense 27,000

Depreciation Expense 15,000

Income Summary 105,000

B) Expenses 105,000 Income Summary 105,000

C) Wages Expense 63,000 Rent Expense 27,000

Depreciation Expense 15,000

Dividends 105,000

D) Income Summary 105,000 Wages Expense 63,000

Rent Expense 27,000

Depreciation Expense 15,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the work sheet for Finley Company to answer the questions that follow.  The journal entry to close revenues would be

The journal entry to close revenues would be

A) debit Income Summary, $155,000; credit Fees Earned, $155,000

B) debit Retained Earnings, $155,000; credit Fees Earned, $155,000

C) debit Fees Earned, $155,000; credit Income Summary, $155,000

D) credit Fees Earned, $155,000; credit Retained Earnings, $155,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The accounting cycle begins with preparing an unadjusted trial balance.

B) False

Correct Answer

verified

Correct Answer

verified

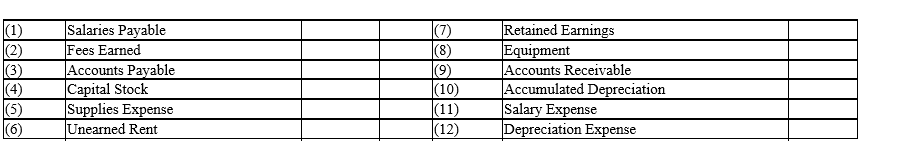

Essay

The balances for the accounts listed below appeared in the Adjusted Trial Balance columns of the work sheet. Indicate whether each balance should be extended to (a) the Income Statement columns or (b) the Balance Sheet columns.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A net loss appears on the work sheet in the

A) debit column of the Balance Sheet columns

B) credit column of the Balance Sheet columns

C) debit column of the Income Statement columns

D) credit column of the Adjustments columns

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The post-closing trial balance will generally have fewer accounts than the trial balance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

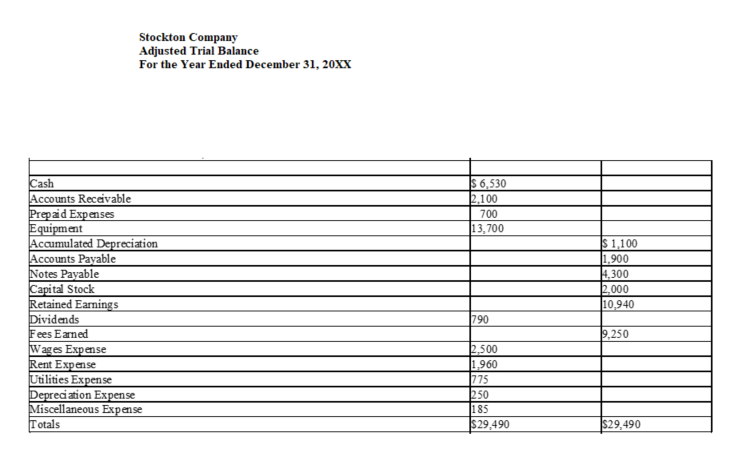

Use the information in the adjusted trial balance for Stockton Company to answer the questions that follow.  Determine the net income (loss) for the period.

Determine the net income (loss) for the period.

A) Net Income $9,250

B) Net Loss $790

C) Net Loss $5,670

D) Net Income $3,580

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The totals of the Adjusted Trial Balance columns on a work sheet will always be the sum of the Trial Balance column totals and the Adjustments column totals.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

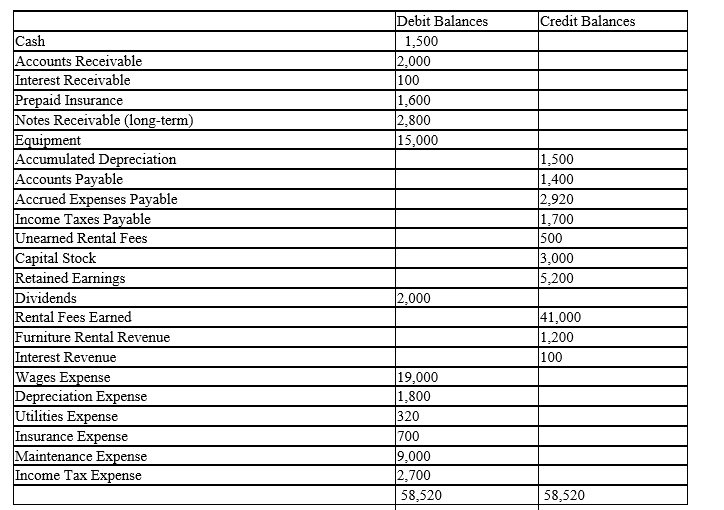

Beachside Realty rents condominiums and furnishings. It's adjusted trial balance at December 31, 2011, is as follows:

Prepare the entry required to close the revenue accounts at the end of the period.

Prepare the entry required to close the revenue accounts at the end of the period.

Correct Answer

verified

Correct Answer

verified

True/False

The income summary account is closed to the retained earnings account.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 198

Related Exams