A) consolidating of the partnership

B) liquidating of the partnership

C) realization of the partnership

D) dissolution of the partnership

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a new partner purchases the entire interest of an old partner,the new partner's capital account should be credited for the amount he or she paid to the old partner.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Craig-Doran Partnership owns inventory that was purchased for $85,000,has a current replacement cost of $54,500,and is priced to sell for $98,000.At what amount should the inventory be recorded in the accounts of the new partnership if Alexis is to be admitted?

A) $98,000

B) $54,500

C) $85,000

D) $79,167

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Partners Ken and Macki each have a $40,000 capital balance and share income and losses in the ratio of 3:2.Cash equals $20,000,noncash assets equal $120,000,and liabilities equal $60,000.If the noncash assets are sold for $50,000,and each partner is personally insolvent,Partner Macki will eventually receive cash of

A) $0

B) $10,000

C) $12,000

D) $20,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A partnership liquidation occurs when

A) a new partner is admitted

B) a partner dies

C) the ownership interest of one partner is sold to a new partner

D) the assets are sold, liabilities paid, and business operations terminated

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Amazon invested $128,000 in the Jungle and River Partnership for ownership equity of $128,000.Prior to the investment,equipment was revalued to a market value of $90,000 from a book value of $72,000.Jungle and River share net income in a 2:1 ratio.Required (a)Provide the journal entry for the revaluation of equipment. (b)Provide the journal entry to admit Amazon.

Correct Answer

verified

Correct Answer

verified

Essay

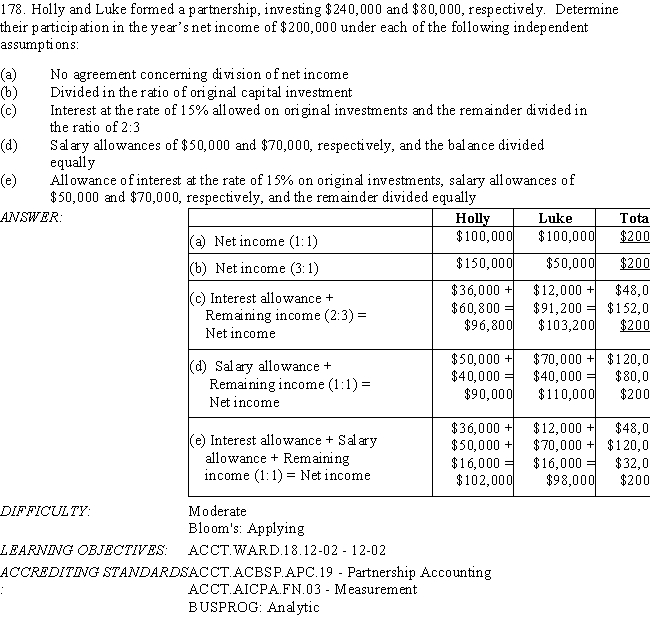

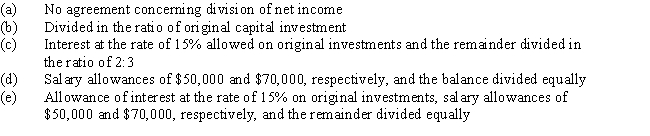

-Holly and Luke formed a partnership,investing $240,000 and $80,000,respectively.Determine their participation in the year's net income of $380,000 under each of the following independent assumptions:

-Holly and Luke formed a partnership,investing $240,000 and $80,000,respectively.Determine their participation in the year's net income of $380,000 under each of the following independent assumptions:

Correct Answer

verified

Correct Answer

verified

True/False

When a new partner is admitted by making an investment in the partnership,the old partners' capital accounts are always credited.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a partnership liquidation,if a partner has a debit capital balance in his or her capital account,he or she is responsible for contributing personal assets sufficient to eliminate the deficit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Calvin-Dogwood Partnership owns inventory that was purchased for $90,000,has a current replacement cost of $85,900,and is priced to sell for $125,000.At what amount should the inventory be recorded in the accounts of the new partnership if Alexis is to be admitted?

A) $129,100

B) $85,900

C) $90,000

D) $125,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When a partner invests noncash assets in a partnership,the assets are recorded at the partner's book value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A partnership is a legal entity separate from its owners.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

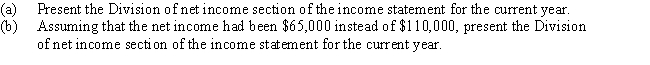

Rodgers and Winter had capital balances of $60,000 and $90,000,respectively,at the beginning of the current fiscal year.The articles of partnership provide for salary allowances of $25,000 and $30,000,respectively; an allowance of interest at 12% on the capital balances at the beginning of the year; and the remaining net income divided equally.Net income for the current year was $110,000.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carrie and Callie form a partnership in which Carrie contributes $85,000 in assets and agrees to devote half time to the partnership.Callie contributed $50,000 in assets and agrees to devote full time to the partnership.If no additional information is available,how will Carrie and Callie share in the division of income?

A) 5:8.5

B) 1:2

C) 1:1

D) 2:1

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Singer and McMann are partners in a business.Singer's original capital was $40,000 and McMann's was $60,000.They agree to salaries of $12,000 and $18,000 for Singer and McMann,respectively,and 10% interest on original capital.If they agree to share the remaining profits and losses on a 3:2 ratio,what will Singer's share of the income be if the income for the year is $50,000?

A) $24,000

B) $22,000

C) $16,000

D) $23,400

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The equity reporting for a limited liability company is similar to that of a partnership,but the changes in capital are shown on a statement of members' equity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a new partner is admitted to a partnership,

A) a bonus may be attributable to the old partner

B) a bonus may only result from more cash being given by the new partner than the value of the assets being purchased

C) a bonus agreed upon by the partners is recorded as an asset so long as the amount is within the range set by the SEC

D) a bonus is not recorded

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The amount that a partner withdraws as a monthly salary allowance does not affect the division of net income.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

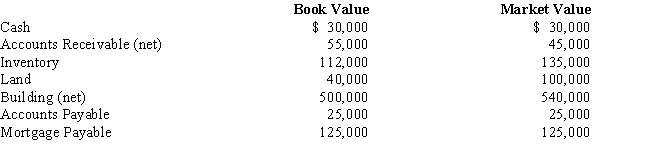

Brad Simmons,sole proprietor of a hardware business,decides to form a partnership with Rich Winter.Brad's accounts are as follows:  Rich agrees to contribute $170,000 for a 20% interest.Journalize the entries to record

(a)Brad's investment and

(b)Rich's investment.

Rich agrees to contribute $170,000 for a 20% interest.Journalize the entries to record

(a)Brad's investment and

(b)Rich's investment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benson and Orton are partners who share income in the ratio of 1:3 and have capital balances of $70,000 and $30,000,respectively.Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000.What is Orton's capital balance after admitting Ramsey?

A) $20,000

B) $9,000

C) $70,000

D) $63,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 199

Related Exams