A) $40,000

B) $15,000

C) $35,000

D) $30,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Everett,Miguel,and Ramona are partners,sharing income 1:2:3.After selling all of the assets for cash,dividing losses on realization,and paying liabilities,the balances in the capital accounts are as follows: Everett,$50,000 Cr.; Miguel,$40,000 Dr.; and Ramona,$30,000 Cr.How much cash is available for distribution to the partners?

A) $120,000

B) $30,000

C) $40,000

D) $90,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Teri,Doug,and Brian are partners with capital balances of $20,000,$30,000,and $50,000,respectively.They share income and losses in the ratio of 3:2:1.Revenue accounts for the period total $350,000.Expense accounts for the period total $380,000.The revenue and expense accounts are closed to the capital accounts.Doug withdraws from the partnership.How much cash does he receive upon withdrawal?

A) $30,000

B) $20,000

C) $40,000

D) $24,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Revenue per employee may be used to measure partnership (LLC)efficiency.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a partner withdraws from the partnership by selling his or her interest back to the partnership,the remaining partners must pay the withdrawing partner a specified amount from their personal assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benton and Orton are partners who share income in the ratio of 1:3 and have capital balances of $70,000 and $30,000,respectively.Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000.What is Benton's capital balance after admitting Ramsey?

A) $20,000

B) $7,000

C) $70,000

D) $63,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) : -An association of two or more persons to own and manage a business for profit

A) Deficiency

B) Realization

C) Proprietorship

D) Partnership

E) Mutual agency

F) Liquidation

G) Income-sharing ratio

H) Statement of partnership equity

J) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paul and Roger are partners who share income in the ratio of 3:2.Their capital balances are $90,000 and $130,000,respectively.The partnership generated net income of $50,000 for the year.What is Paul's capital balance after closing the revenue and expense accounts to the capital accounts?

A) $108,000

B) $120,000

C) $115,000

D) $180,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adriana and Belen are partners who share income in the ratio of 3:2 and have capital balances of $50,000 and $90,000 at the time they decide to terminate the partnership.After all noncash assets are sold and all liabilities are paid,there is a cash balance of $90,000.How much cash should be distributed to Adriana?

A) $50,000

B) $20,000

C) $30,000

D) $45,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

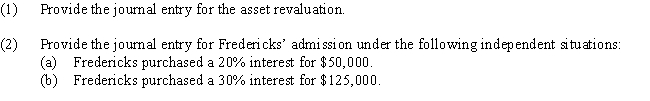

Essay

S.Stephens and J.Perez are partners in Space Designs.Stephens and Perez share income equally.D.Fredericks will be admitted to the partnership.Prior to the admission,equipment was revalued downward by $8,000.The capital balances of each partner are $100,000 and $139,000,respectively,prior to the revaluation.Required

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each statement to the appropriate term (a-h) : -The share of loss on realization is greater than the balance in partner capital

A) Deficiency

B) Realization

C) Proprietorship

D) Partnership

E) Mutual agency

F) Liquidation

G) Income-sharing ratio

H) Statement of partnership equity

J) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The remaining cash of a partnership (after creditors have been paid) upon liquidation is divided among partners according to their

A) capital balances

B) contribution of assets

C) drawing balances

D) income sharing ratio

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Singer and McMann are partners in a business.Singer's original capital was $40,000 and McMann's was $60,000.They agree to salaries of $12,000 and $18,000 for Singer and McMann,respectively,and 10% interest on original capital.If they agree to share the remaining profits and losses in a 3:2 ratio,what will Singer's share of the income be if the income for the year is $15,000?

A) $9,000

B) $2,400

C) $1,000

D) $5,600

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the four major forms of business entities that are discussed in this chapter?

A) sole proprietorship

B) corporation

C) partnership

D) subchapter S corporation

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Patty and Paul are partners who share income in the ratio of 3:2.Their capital balances are $90,000 and $130,000,respectively,on January 1.The partnership generated net income of $40,000 for the year.What is Paul's capital balance after closing the revenue and expense accounts to the capital accounts?

A) $120,000

B) $146,000

C) $164,000

D) $160,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A partnership is subject to federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Singer and McMann are partners in a business.Singer's original capital was $40,000 and McMann's was $60,000.They agree to salaries of $12,000 and $18,000 for Singer and McMann,respectively,and 10% interest on original capital.If they agree to share the remaining profits and losses on a 3:2 ratio,what will McMann's share of the income be if the income for the year is $15,000?

A) $6,000

B) $9,400

C) $12,600

D) $14,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lambert invests $20,000 for a 1/3 interest in a partnership in which the other partners have capital totaling $34,000 before admitting Lambert.After distribution of the bonus,what is Lambert's capital?

A) $18,000

B) $20,000

C) $6,667

D) $11,333

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A limited liability company is a business entity form designed to overcome some of the disadvantages of the partnership form.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an advantage of a general partnership when compared to a corporation?

A) A partnership is more likely to have a positive net income.

B) The partnership is relatively inexpensive to organize.

C) Creditors to a partnership cannot attach personal assets of partners.

D) The partnership usually hires professional managers.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 199

Related Exams