B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cavendish Company recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. This action had no effect on the company's total assets or operating income. Which of the following effects would occur as a result of this action?

A) the company's debt ratio increased.

B) the company's current ratio increased.

C) the company's times interest earned ratio decreased.

D) the company's basic earning power ratio increased.

E) the company's equity multiplier increased.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the CEO of a large, diversified, firm were filling out a fitness report on a division manager (i.e., "grading" the manager) , which of the following situations would be likely to cause the manager to receive a better grade? In all cases, assume that other things are held constant.

A) the division's dso (days' sales outstanding) is 40, whereas the average for its competitors is 30.

B) the division's basic earning power ratio is above the average of other firms in its industry.

C) the division's total assets turnover ratio is below the average for other firms in its industry.

D) the division's debt ratio is above the average for other firms in the industry.

E) the division's inventory turnover is 6, whereas the average for its competitors is 8.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Mason Inc. had a total assets turnover of 1.33 and an equity multiplier of 1.75. Its sales were $195,000 and its net income was $10,549. The CFO believes that the company could have operated more efficiently, lowered its costs, and increased its net income by $5,250 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income in this amount, by how much would the ROE have changed?

A) 5.66%

B) 5.95%

C) 6.27%

D) 6.58%

E) 6.91%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

One problem with ratio analysis is that relationships can be manipulated. For example, we know that if our current ratio is less than 1.0, then using some of our cash to pay off some of our current liabilities would cause the current ratio to increase and thus make the firm look stronger.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Even though Firm A's current ratio exceeds that of Firm B, Firm B's quick ratio might exceed that of A. However, if A's quick ratio exceeds B's, then we can be certain that A's current ratio is also larger than that of B.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the coming year, Crane Inc. is considering two financial plans. Management expects sales to be $301,770, operating costs to be $266,545, assets to be $200,000, and its tax rate to be 35%. Under Plan A it would use 25% debt and 75% common equity. The interest rate on the debt would be 8.8%, but the TIE ratio would have to be kept at 4.00 or more. Under Plan B the maximum debt that met the TIE constraint would be employed. Assuming that sales, operating costs, assets, the interest rate, and the tax rate would all remain constant, by how much would the ROE change in response to the change in the capital structure?

A) 3.83%

B) 4.02%

C) 4.22%

D) 4.43%

E) 4.65%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) if two firms differ only in their use of debtσi.e., they have identical assets, sales, operating costs, and tax ratesσbut one firm has a higher debt ratio, the firm that uses more debt will have a higher profit margin on sales.

B) if one firm has a higher debt ratio than another, we can be certain that the firm with the higher debt ratio will have the lower tie ratio, as that ratio depends entirely on the amount of debt a firm uses.

C) a firm's use of debt will have no effect on its profit margin on sales.

D) if two firms differ only in their use of debtσi.e., they have identical assets, sales, operating costs, interest rates on their debt, and tax ratesσbut one firm has a higher debt ratio, the firm that uses more debt will have a lower profit margin on sales.

E) the debt ratio as it is generally calculated makes an adjustment for the use of assets leased under operating leases, so the debt ratios of firms that lease different percentages of their assets are still comparable.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget, the current and quick ratios provide fast and easy-to-use measures of a firm's liquidity position.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonner Corp.'s sales last year were $415,000, and its year-end total assets were $355,000. The average firm in the industry has a total assets turnover ratio (TATO) of 2.4. Bonner's new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales. By how much must the assets be reduced to bring the TATO to the industry average, holding sales constant?

A) $164,330

B) $172,979

C) $182,083

D) $191,188

E) $200,747

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which of the following actions would increase its current ratio?

A) use cash to increase inventory holdings.

B) reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and equipment.

C) use cash to repurchase some of the company's own stock.

D) borrow using short-term debt and use the proceeds to repay debt that has a maturity of more than one year.

E) issue new stock and then use some of the proceeds to purchase additional inventory and hold the remainder as cash.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The "apparent," but not the "true," financial position of a company whose sales are seasonal can differ dramatically, depending on the time of year when the financial statements are constructed.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amram Company's current ratio is 1.9. Considered alone, which of the following actions would reduce the company's current ratio?

A) use cash to reduce accounts payable.

B) borrow using short-term notes payable and use the proceeds to reduce accruals.

C) borrow using short-term notes payable and use the proceeds to reduce long-term debt.

D) use cash to reduce accruals.

E) use cash to reduce short-term notes payable.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

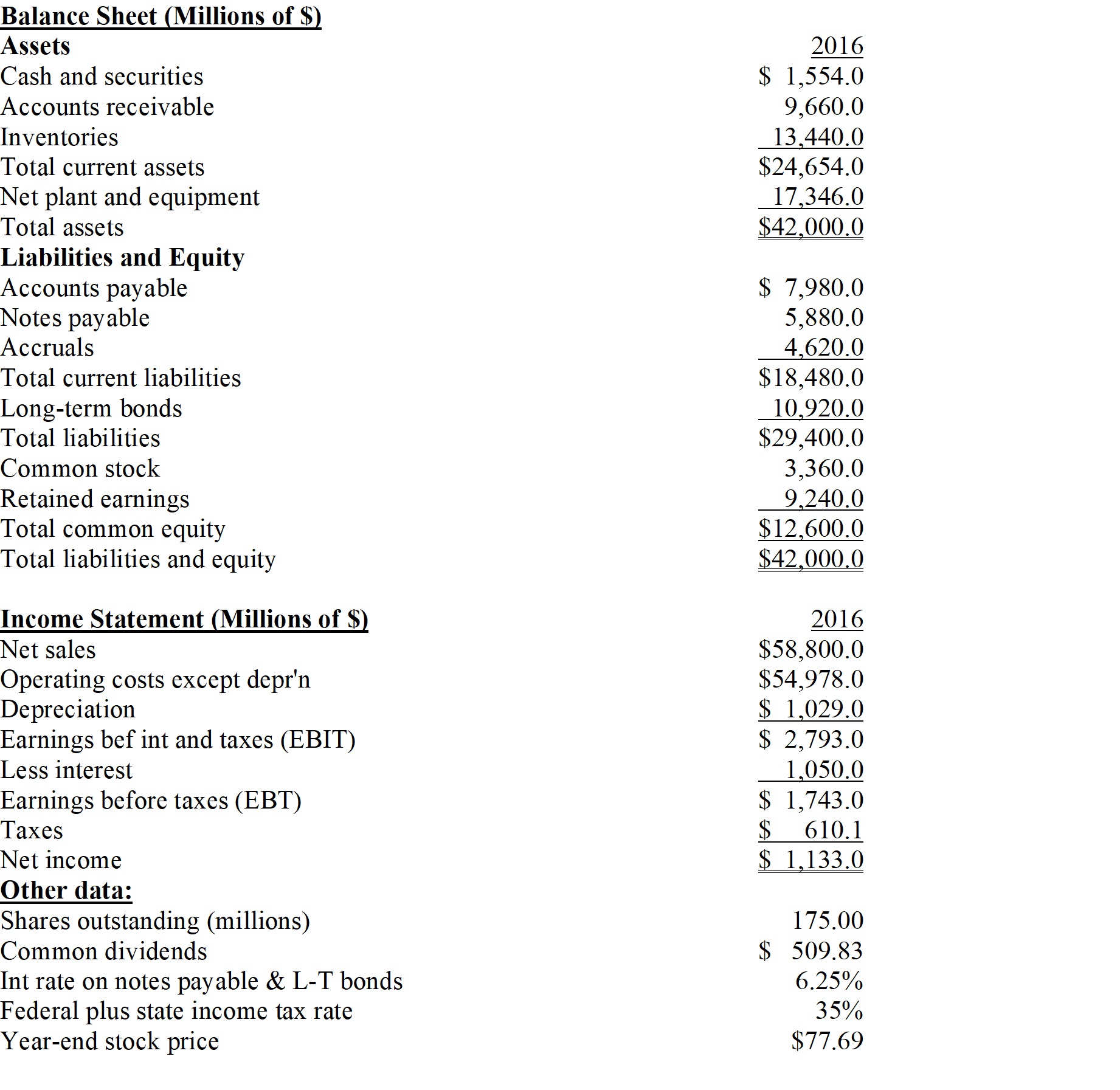

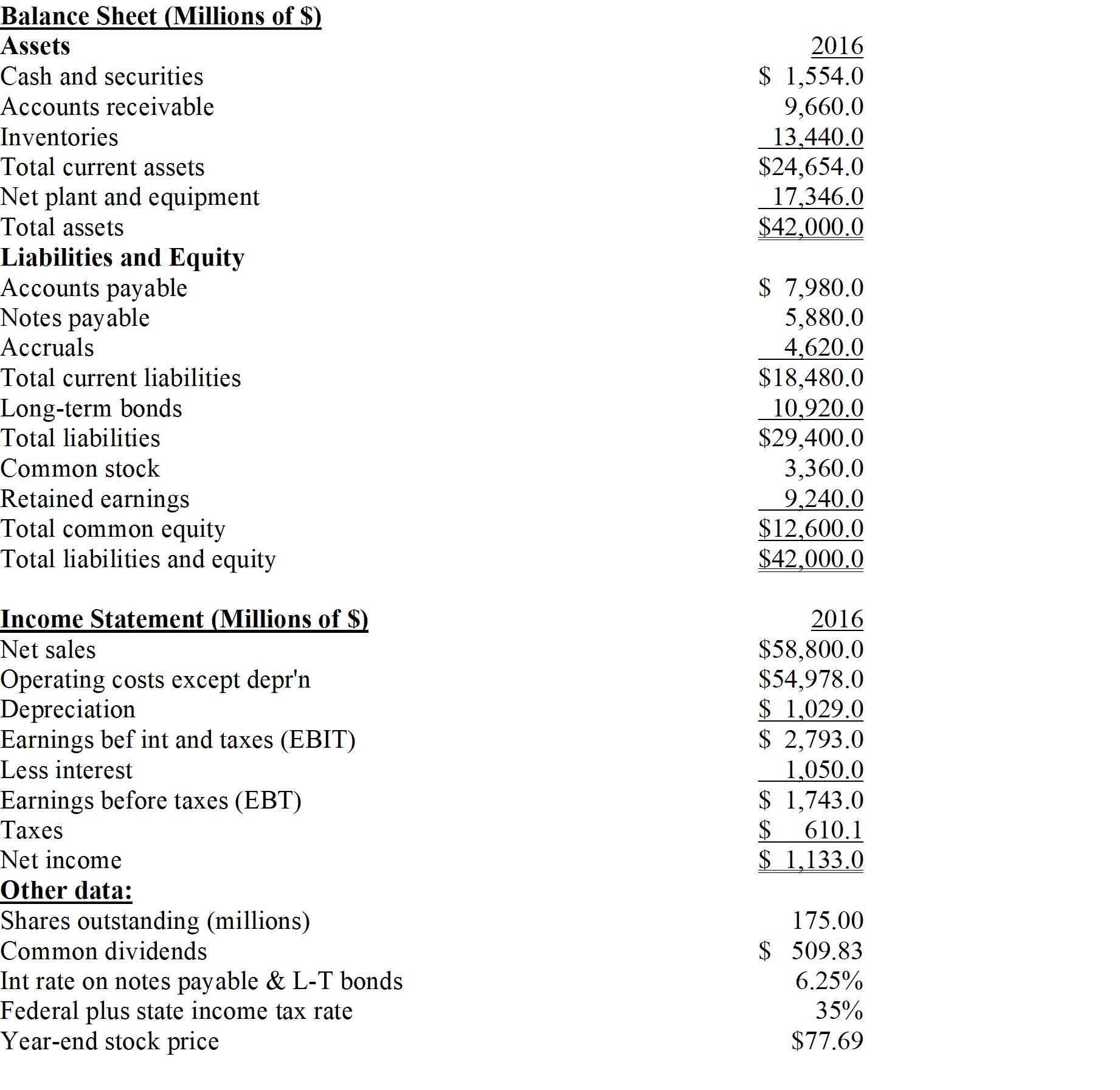

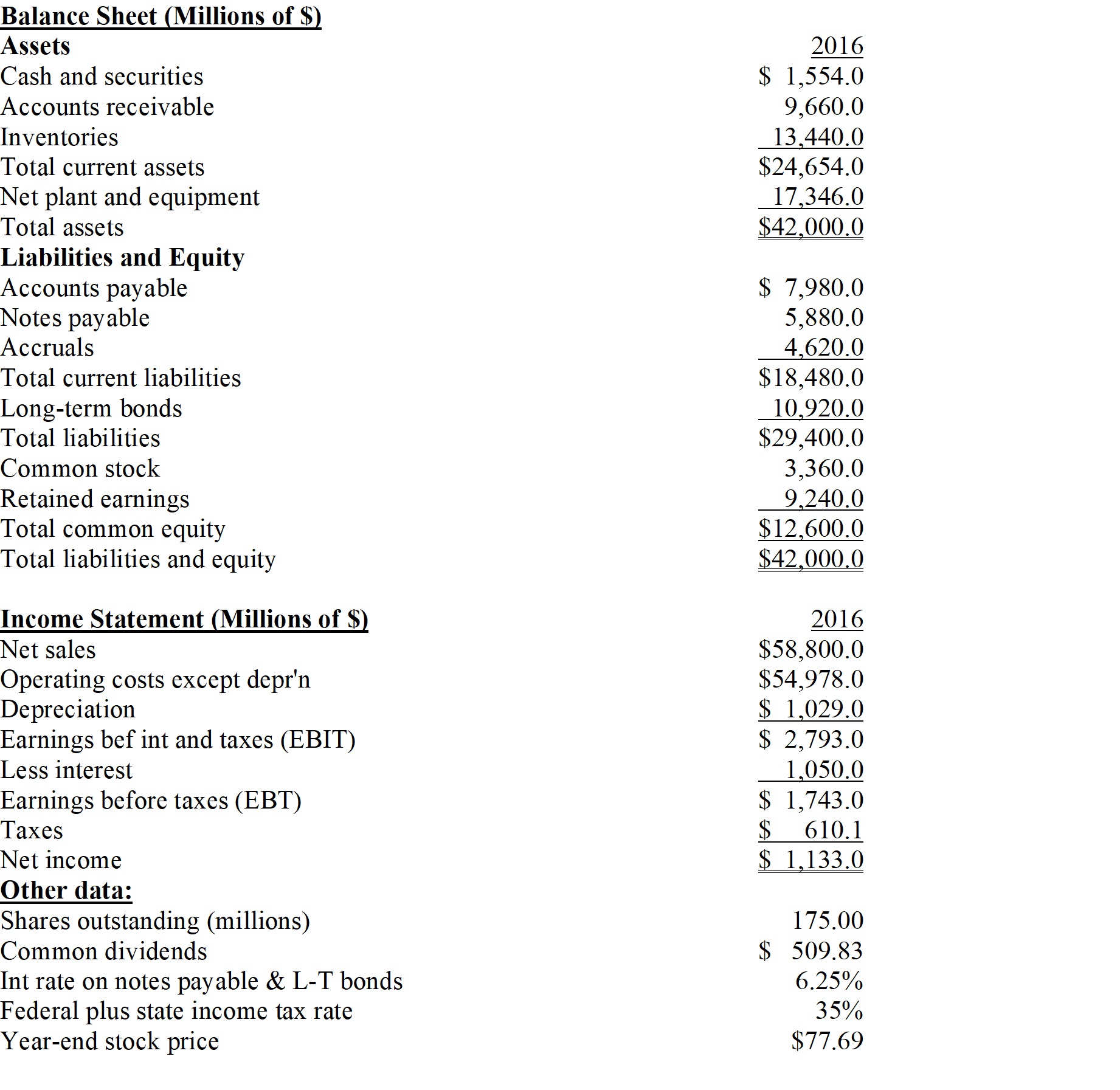

Muscarella Inc. has the following balance sheet and income statement data: The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average, 2.70, without affecting either sales or net income. Assuming that inventories are sold off and not replaced to get the current ratio to the target level, and that the funds generated are used to buy back common stock at book value, by how much would the ROE change?

A) 4.28%

B) 4.50%

C) 4.73%

D) 4.96%

E) 5.21%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's days sales outstanding?Assume a 360-day year for this calculation.

-Refer to the data for Pettijohn Inc.What is the firm's days sales outstanding?Assume a 360-day year for this calculation.

A) 48.17

B) 50.71

C) 53.38

D) 56.19

E) 59.14

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

High current and quick ratios always indicate that a firm is managing its liquidity position well.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) if firms x and y have the same net income, number of shares outstanding, and price per share, then their market-to-book ratios must also be the same.

B) if firms x and y have the same p/e ratios, then their market-to-book ratios must also be the same.

C) if firms x and y have the same net income, number of shares outstanding, and price per share, then their p/e ratios must also be the same.

D) if firms x and y have the same earnings per share and market-to-book ratio, they must have the same price earnings ratio.

E) if firm x's p/e ratio exceeds that of firm y, then y is likely to be less risky and also to be expected to grow at a faster rate.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's book value per share?

-Refer to the data for Pettijohn Inc.What is the firm's book value per share?

A) $61.73

B) $64.98

C) $68.40

D) $72.00

E) $75.60

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cordelion Communications is considering issuing new common stock and using the proceeds to reduce its outstanding debt. The stock issue would have no effect on total assets, the interest rate Cordelion pays, EBIT, or the tax rate. Which of the following is likely to occur if the company goes ahead with the stock issue?

A) the times interest earned ratio will decrease.

B) the roa will decline.

C) taxable income will decrease.

D) the tax bill will increase.

E) net income will decrease.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pettijohn Inc.

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to the data for Pettijohn Inc.What is the firm's inventory turnover ratio?

-Refer to the data for Pettijohn Inc.What is the firm's inventory turnover ratio?

A) 4.17

B) 4.38

C) 4.59

D) 5.82

E) 5.07

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 104

Related Exams