Correct Answer

verified

Correct Answer

verified

Short Answer

Under the indirect method, a gain from the sale of land is subtracted from ___________ in the operating activities section of the statement of cash flows.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using the indirect method to determine operating cash flows, how is the purchase of equipment for cash shown on the Statement of Cash Flows?

A) operating activity

B) investing activity

C) financing activity

D) noncash investing and financing activity

E) not reported on the statement of cash flows

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

If the balance of wages payable increases during the year, then the ____________________ for the period will be greater than the actual cash wages paid in the period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a financing activity?

A) Issuing bonds for cash.

B) Selling an investment in IBM stock for cash.

C) Purchasing a company's own stock (treasury stock) for cash.

D) Making a cash payment to repay a bank loan.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

MATCHING Use the following codes to indicate how the cash flow effect, if any, of each transaction would be reported on a statement of cash flows if the operating activities section is prepared using the direct method. (Choices may be used more than once.) a.Inflow from operating activity b.Outflow from operating activity c.Inflow from investing activity d.Outflow from investing activity e.Inflow from financing activity f.Outflow from financing activity g.Noncash investing and financing activity h.Not reported on statement of cash flows -Received payments from accounts receivable.

Correct Answer

verified

Correct Answer

verified

True/False

Increases in Cash = Increases in Liabilities + Increases in Stockholders' Equity + Decreases in Noncash Assets.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

During 2014, the operations of a shipping company provided net cash flows of $600,000. The company made capital expenditures of $270,000 and paid dividends of $130,000.

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from selling machinery would be classified as investing activities.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

When using the indirect method to determine operating cash flows, how is an increase in accounts receivable during the year shown on the Statement of Cash Flows?

A) operating activity

B) investing activity

C) financing activity

D) noncash investing and financing activity

E) not reported on the statement of cash flows

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match these terms with their correct definition. a.Cash flow adequacy ratio b.Cash flows from financing activities c.Cash flows from investing activities d.Cash flow from operating activities e.Direct method f.Free cash flow g.Income statement h.Indirect method i.Noncash investing & financing activities j.Statement of cash flows -Provides several pieces of information needed to prepare the cash flow statement.

Correct Answer

verified

Correct Answer

verified

Essay

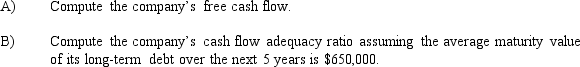

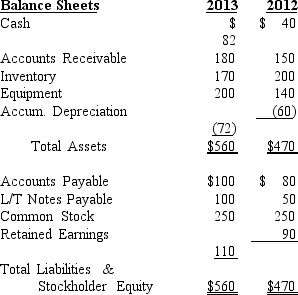

Maytag Corporation's balance sheets for the last 2 years are provided below:

The company's income statement for 2013 is provided below:

The company's income statement for 2013 is provided below:

*The company sold equipment for $57 which had a cost of $60.

A)Prepare the company's Statement of Cash flows for 2013. Use the direct method of computing cash flows from operating activities.

B)Prepare the Cash Flows from Operating Activities section of the cash flow statement using the indirect method.

*The company sold equipment for $57 which had a cost of $60.

A)Prepare the company's Statement of Cash flows for 2013. Use the direct method of computing cash flows from operating activities.

B)Prepare the Cash Flows from Operating Activities section of the cash flow statement using the indirect method.

Correct Answer

verified

A) 11ea7daa_2c5c_9a87_b9bd_dfec2a0c09cd_TB2047_00_TB2047_00

Correct Answer

verified

True/False

The Statement of Cash Flows is considered to be a good indicator of current cash inflows and outflows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Companies can use two different methods to report the amount of cash flow from their investing and financing activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which method of preparing the operating activities section of a statement of cash flows adjusts net income to remove the effects of deferrals and accruals for revenues and expenses?

A) the direct method

B) the indirect method

C) Both the direct and indirect methods.

D) Neither the direct method nor the indirect method.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

Use the following codes to indicate how the cash flow effect, if any, of each transaction or event would be reported on a statement of cash flows if the operating activities section is prepared using the indirect method. (Choices may be used more than once.) a.Operating activity--add to net income b.Operating activity--deduct from net income c.Inflow from investing activity d.Outflow from investing activity e.Inflow from financing activity f.Outflow from financing activity g.Noncash investing and financing activity h.Not reported on statement of cash flows -Received cash from the sale of securities.

Correct Answer

verified

C

Correct Answer

verified

Short Answer

Use the following codes to indicate how the cash flow effect, if any, of each transaction or event would be reported on a statement of cash flows if the operating activities section is prepared using the indirect method. (Choices may be used more than once.) a.Operating activity--add to net income b.Operating activity--deduct from net income c.Inflow from investing activity d.Outflow from investing activity e.Inflow from financing activity f.Outflow from financing activity g.Noncash investing and financing activity h.Not reported on statement of cash flows -Increase in the inventory balance.

Correct Answer

verified

Correct Answer

verified

Short Answer

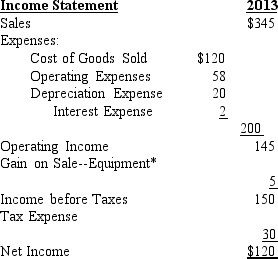

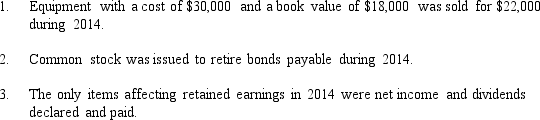

Selected data and additional information from the company's records are presented below:

Additional information:

Additional information:

-Refer to Mary Kay Cosmetics. Prepare the operating activities section of a statement of cash flows for 2014 assuming the use of the indirect method of determining net cash flow from operating activities.

-Refer to Mary Kay Cosmetics. Prepare the operating activities section of a statement of cash flows for 2014 assuming the use of the indirect method of determining net cash flow from operating activities.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Metz Vets. Which of the following activities results in a cash inflow?

A) increases in noncash current assets (NCCA)

B) decreases in current liabilities (CL)

C) increases in common stock (CS)

D) decreases in retained earnings (RE)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most likely to be right?

A) The method of preparing the operating activities section of a statement of cash flows which adjusts net income to remove the effects of deferrals and accruals for revenues and expenses is the direct method.

B) The method of preparing the operating activities section of a statement of cash flows which reports major classes of gross cash receipts and cash payments for revenues and expenses is the indirect method.

C) The FASB prefers the indirect method of preparing the operating activities section of the statement of cash flows.

D) Most companies use the indirect method of preparing the operating activities section of the statement of cash flows.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 206

Related Exams