B) False

Correct Answer

verified

Correct Answer

verified

True/False

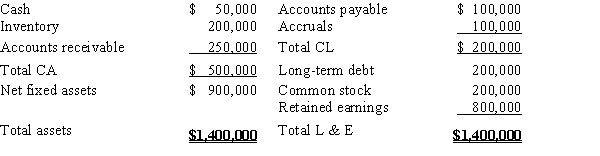

Consider the following balance sheet,for Games Inc.Because Games has $800,000 of retained earnings,we know that the company would be able to pay cash to buy an asset with a cost of $200,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant,which of the following actions would increase the amount of cash on a company's balance sheet?

A) The company repurchases common stock.

B) The company pays a dividend.

C) The company issues new common stock.

D) The company gives customers more time to pay their bills.

E) The company purchases a new piece of equipment.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Houston Pumps recently reported $185,250 of sales,$140,500 of operating costs other than depreciation,and $9,250 of depreciation.The company had $35,250 of outstanding bonds that carry a 6.75% interest rate,and its federal-plus-state income tax rate was 35%.In order to sustain its operations and thus generate future sales and cash flows,the firm was required to spend $15,250 to buy new fixed assets and to invest $6,850 in net operating working capital.What was the firm's free cash flow?

A) $10,225

B) $10,736

C) $11,273

D) $11,837

E) $12,429

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allen Corporation can (1) build a new plant that should generate a before-tax return of 11%,or (2) invest the same funds in the preferred stock of Florida Power & Light (FPL) ,which should provide Allen with a before-tax return of 9%,all in the form of dividends.Assume that Allen's marginal tax rate is 25%,and that 70% of dividends received are excluded from taxable income.If the plant project is divisible into small increments,and if the two investments are equally risky,what combination of these two possibilities will maximize Allen's effective return on the money invested?

A) All in the plant project.

B) All in FPL preferred stock.

C) 60% in the project; 40% in FPL.

D) 60% in FPL; 40% in the project.

E) 50% in each.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) Retained earnings, as reported on the balance sheet, represents the amount of cash a company has available to pay out as dividends to shareholders.

B) 70% of the interest received by corporations is excluded from taxable income.

C) 70% of the dividends received by corporations is excluded from taxable income.

D) Because taxes on long-term capital gains are not paid until the gain is realized, investors must pay the top individual tax rate on that gain.

E) The corporate tax system favors equity financing, as dividends paid are deductible from corporate taxes.

G) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A 5-year corporate bond yields 9%.A 5-year municipal bond of equal risk yields 6.5%.Assume that the state tax rate is zero.At what federal tax rate are you indifferent between the two bonds?

A) 27.78%

B) 29.17%

C) 30.63%

D) 32.16%

E) 33.76%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in accounts receivable represents an increase in net cash provided by operating activities because receivables will produce cash when they are collected.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A good bit of relatively simple arithmetic is involved in some of these problems, and although the calculations are simple, it will take students some time to set up the problem and do the arithmetic. We allow for this when assigning problems for a timed test. Also, students must use a number of definitions to answer some of the questions. To avoid excessive memorization, we provide students with a list of formulas and definitions for use on exams. Problems with * in the topic line are nonalgorithmic. -Bauer Software's current balance sheet shows total common equity of $5,125,000.The company has 530,000 shares of stock outstanding,and they sell at a price of $27.50 per share.By how much do the firm's market and book values per share differ?

A) $17.83

B) $18.72

C) $19.66

D) $20.64

E) $21.67

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Austin Financial recently announced that its net income increased sharply from the previous year,yet its net cash provided from operations declined.Which of the following could explain this performance?

A) The company's dividend payment to common stockholders declined.

B) The company's expenditures on fixed assets declined.

C) The company's cost of goods sold increased.

D) The company's depreciation expense declined.

E) The company's interest expense increased.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Assets other than cash are expected to produce cash over time,but the amount of cash they eventually produce could be higher or lower than the amounts at which the assets are carried on the books.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Emery Mining Inc.recently reported $150,000 of sales,$75,500 of operating costs other than depreciation,and $10,200 of depreciation.The company had $16,500 of outstanding bonds that carry a 7.25% interest rate,and its federal-plus-state income tax rate was 35%.How much was the firm's net income? The firm uses the same depreciation expense for tax and stockholder reporting purposes.

A) $35,167.33

B) $37,018.24

C) $38,966.57

D) $41,017.44

E) $43,068.31

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year,Delip Industries had (1) negative cash flow from operations,(2) a negative free cash flow,and (3) an increase in cash as reported on its balance sheet.Which of the following factors could explain this situation?

A) The company had a sharp increase in its inventories.

B) The company had a sharp increase in its accrued liabilities.

C) The company sold a new issue of common stock.

D) The company made a large capital investment early in the year.

E) The company had a sharp increase in depreciation expenses.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Because the U.S.tax system is a progressive tax system,a taxpayer's marginal and average tax rates are the same.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Most rapidly growing companies have positive free cash flows because cash flows from existing operations generally exceed fixed asset purchases and changes to net operating working capital.

B) Changes in working capital have no effect on free cash flow.

C) Free cash flow (FCF) is defined as follows:FCF =EBIT(1 − T) + Depreciation− Capital expenditures required to sustain operations− Required changes in net operating working capital.

D) Free cash flow (FCF) is defined as follows:FCF = EBIT(1 − T) + Capital expenditures.

E) Managers should be less concerned with free cash flow than with accounting net income. Accounting net income is the "bottom line" and represents how much the firm can distribute to all its investors, both creditors and stockholders.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) An increase in accounts receivable is added to net income in the operating activities section because if accounts receivable increase, then when they are collected cash will come into the firm.

B) In finance, we are generally more interested in cash flows than in accounting profits. Free cash flow (FCF) is calculated as after-tax operating income plus depreciation less the sum of capital expenditures and the change in net operating working capital. Free cash flow is the amount of cash that could be withdrawn without harming the firm's ability to operate and to produce future cash flows.

C) The first major section of a typical statement of cash flows is "Operating Activities," and the first entry in this section is "Net Income." Then, also in the first section, we show some items that add to or subtract from cash, and the last entry is called "Net Cash Provided by Operating Activities." This number can be either positive or negative, but if it is negative, the firm is almost certain to soon go bankrupt.

D) The next-to-last line on the income statement shows the firm's earnings, while the last line shows the dividends the company paid. Therefore, the dividends are frequently called "the bottom line."

E) Most rapidly growing companies have positive free cash flows because cash flows from existing operations will exceed fixed assets and working capital needed to support the growth.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A start-up firm is making an initial investment in new plant and equipment.Assume that currently its equipment must be depreciated on a straight-line basis over 10 years,but Congress is considering legislation that would require the firm to depreciate the equipment over 7 years.If the legislation becomes law,which of the following would occur in the year following the change?

A) The firm's operating income (EBIT) would increase.

B) The firm's taxable income would increase.

C) The firm's cash flow would increase.

D) The firm's tax payments would increase.

E) The firm's reported net income would increase.

G) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The CFO of Daves Industries plans to have the company issue $300 million of new common stock and use the proceeds to pay off some of its outstanding bonds that carry a 7% interest rate.Assume that the company,which does not pay any dividends,takes this action,and that total assets,operating income (EBIT) ,and its tax rate all remain constant.Which of the following would occur?

A) The company's taxable income would fall.

B) The company's interest expense would remain constant.

C) The company would have less common equity than before.

D) The company's net income would increase.

E) The company would have to pay less taxes.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

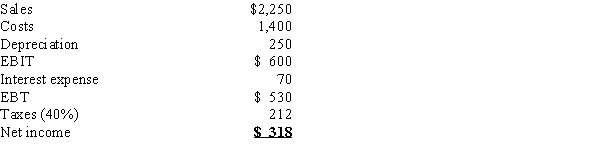

Kwok Enterprises has the following income statement.How much after-tax operating income does the firm have?

A) $325

B) $342

C) $360

D) $378

E) $397

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Two metrics that are used to measure a company's financial performance are net income and cash flow.Accountants emphasize net income as calculated in accordance with generally accepted accounting principles.Finance people generally put at least as much weight on cash flows as they do on net income.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 130

Related Exams