A) $339

B) $377

C) $396

D) $415

E) $440

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

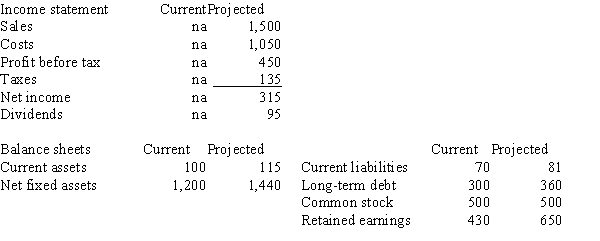

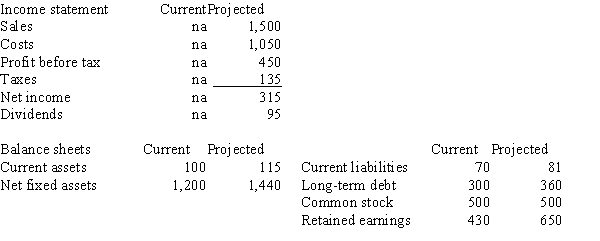

Below are the simplified current and projected financial statements for Decker Enterprises. All of Decker's assets are operating assets. All of Decker's current liabilities are operating liabilities.  -Based on the projections,Decker will have

-Based on the projections,Decker will have

A) a financing surplus of $36

B) a financing deficit of $36

C) a financing surplus of $255

D) a financing deficit of $255

E) zero financing surplus or deficit

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year National Aeronautics had a FA/Sales ratio of 40%,comprised of $250 million of sales and $100 million of fixed assets.However,its fixed assets were used at only 75% of capacity.Now the company is developing its financial forecast for the coming year.As part of that process,the company wants to set its target Fixed Assets/Sales ratio at the level it would have had had it been operating at full capacity.What target FA/Sales ratio should the company set?

A) 28.5%

B) 30.0%

C) 31.5%

D) 33.1%

E) 34.7%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If a firm with a positive net worth is operating its fixed assets at full capacity,if its dividend payout ratio is 100%,and if it wants to hold all financial ratios constant,then for any positive growth rate in sales,it will require external financing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Below are the simplified current and projected financial statements for Decker Enterprises. All of Decker's assets are operating assets. All of Decker's current liabilities are operating liabilities.  -If Decker had a financing deficit,it could remedy the situation by

-If Decker had a financing deficit,it could remedy the situation by

A) buying back common stock

B) paying a special dividend

C) paying down its long-term debt

D) borrowing on its line of credit

E) borrowing from retained earnings

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When fixed assets are added in large, discrete units as a company grows, the assumption of constant ratios is more appropriate than if assets are relatively small and can be added in small increments as sales grow.

B) Firms whose fixed assets are "lumpy" frequently have excess capacity, and this should be accounted for in the financial forecasting process.

C) For a firm that uses lumpy assets, it is impossible to have small increases in sales without expanding fixed assets.

D) There are economies of scale in the use of many kinds of assets. When economies occur the ratios are likely to remain constant over time as the size of the firm increases. The Economic Ordering Quantity model for establishing inventory levels demonstrates this relationship.

E) When we use the AFN equation, we assume that the ratios of assets and liabilities to sales (A0*/S0 and L0*/S0) vary from year to year in a stable, predictable manner.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 46 of 46

Related Exams