A) Project D is probably larger in scale than Project C.

B) Project C probably has a faster payback.

C) Project C probably has a higher IRR.

D) The crossover rate between the two projects is below 12%.

E) Project D probably has a higher IRR.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a firm relies exclusively on the payback method when making capital budgeting decisions,and it sets a 4-year payback regardless of economic conditions.Other things held constant,which of the following statements is most likely to be true?

A) It will accept too many long-term projects and reject too many short-term projects (as judged by the NPV) .

B) The firm will accept too many projects in all economic states because a 4-year payback is too low.

C) The firm will accept too few projects in all economic states because a 4-year payback is too high.

D) If the 4-year payback results in accepting just the right set of projects under average economic conditions, then this payback will result in too few long-term projects when the economy is weak.

E) It will accept too many short-term projects and reject too many long-term projects (as judged by the NPV) .

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

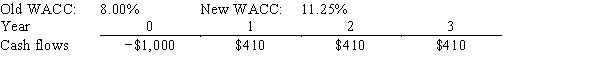

Corner Jewelers,Inc.recently analyzed the project whose cash flows are shown below.However,before the company decided to accept or reject the project,the Federal Reserve changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's expected NPV can be negative,in which case it should be rejected.

A) −$59.03

B) −$56.08

C) −$53.27

D) −$50.61

E) −$48.08

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

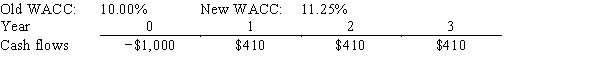

Last month,Standard Systems analyzed the project whose cash flows are shown below.However,before the decision to accept or reject the project took place,the Federal Reserve changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's expected NPV can be negative,in which case it should be rejected.

A) −$18.89

B) −$19.88

C) −$20.93

D) −$22.03

E) −$23.13

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one outflow followed by a series of inflows.

A) The lower the WACC used to calculate a project's NPV, the lower the calculated NPV will be.

B) If a project's NPV is less than zero, then its IRR must be less than the WACC.

C) If a project's NPV is greater than zero, then its IRR must be less than zero.

D) The NPV of a relatively low-risk project should be found using a relatively high WACC.

E) A project's NPV is found by compounding the cash inflows at the IRR to find the terminal value (TV) , then discounting the TV at the WACC.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

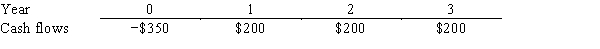

Garner Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 1.42 years

B) 1.58 years

C) 1.75 years

D) 1.93 years

E) 2.12 years

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A basic rule in capital budgeting is that if a project's NPV exceeds its IRR,then the project should be accepted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

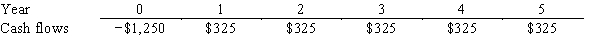

Nichols Inc.is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's IRR can be less than the WACC or negative,in both cases it will be rejected.

A) 9.43%

B) 9.91%

C) 10.40%

D) 10.92%

E) 11.47%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The NPV and IRR methods,when used to evaluate two independent and equally risky projects,will lead to different accept/reject decisions and thus capital budgets if the projects' IRRs are greater than their cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One defect of the IRR method versus the NPV is that the IRR does not take account of the time value of money.

B) One defect of the IRR method versus the NPV is that the IRR does not take account of the cost of capital.

C) One defect of the IRR method versus the NPV is that the IRR values a dollar received today the same as a dollar that will not be received until sometime in the future.

D) One defect of the IRR method versus the NPV is that the IRR does not take proper account of differences in the sizes of projects.

E) One defect of the IRR method versus the NPV is that the IRR does not take account of cash flows over a project's full life.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Conflicts between two mutually exclusive projects occasionally occur,where the NPV method ranks one project higher but the IRR method ranks the other one first.In theory,such conflicts should be resolved in favor of the project with the higher positive NPV.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If the cost of capital declines, this lowers a project's NPV.

B) The NPV method is regarded by most academics as being the best indicator of a project's profitability; hence, most academics recommend that firms use only this one method.

C) A project's NPV depends on the total amount of cash flows the project produces, but because the cash flows are discounted at the WACC, it does not matter if the cash flows occur early or late in the project's life.

D) The NPV and IRR methods may give different recommendations regarding which of two mutually exclusive projects should be accepted, but they always give the same recommendation regarding the acceptability of a normal, independent project.

E) The NPV method was once the favorite of academics and business executives, but today most authorities regard the MIRR as being the best indicator of a project's profitability.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider two projects,X and Y.Project X's IRR is 19% and Project Y's IRR is 17%.The projects have the same risk and the same lives,and each has constant cash flows during each year of their lives.If the WACC is 10%,Project Y has a higher NPV than X.Given this information,which of the following statements is CORRECT?

A) The crossover rate must be greater than 10%.

B) If the WACC is 8%, Project X will have the higher NPV.

C) If the WACC is 18%, Project Y will have the higher NPV.

D) Project X is larger in the sense that it has the higher initial cost.

E) The crossover rate must be less than 10%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If Project A's IRR exceeds Project B's, then A must have the higher NPV.

B) A project's MIRR can never exceed its IRR.

C) If a project with normal cash flows has an IRR less than the WACC, the project must have a positive NPV.

D) If the NPV is negative, the IRR must also be negative.

E) If a project with normal cash flows has an IRR greater than the WACC, the project must also have a positive NPV.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If two projects are mutually exclusive, then they are likely to have multiple IRRs.

B) If a project is independent, then it cannot have multiple IRRs.

C) Multiple IRRs can occur only if the signs of the cash flows change more than once.

D) If a project has two IRRs, then the smaller one is the one that is most relevant, and it should be accepted and relied upon.

E) For a project to have more than one IRR, then both IRRs must be greater than the WACC.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT? Assume that the project being considered has normal cash flows,with one cash outflow at t = 0 followed by a series of positive cash flows.

A) A project's MIRR is always less than its regular IRR.

B) If a project's IRR is greater than its WACC, then its MIRR will be greater than the IRR.

C) To find a project's MIRR, we compound cash inflows at the regular IRR and then find the discount rate that causes the PV of the terminal value to equal the initial cost.

D) To find a project's MIRR, the textbook procedure compounds cash inflows at the WACC and then finds the discount rate that causes the PV of the terminal value to equal the initial cost.

E) A project's MIRR is always greater than its regular IRR.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The IRR of normal Project X is greater than the IRR of normal Project Y,and both IRRs are greater than zero.Also,the NPV of X is greater than the NPV of Y at the cost of capital.If the two projects are mutually exclusive,Project X should definitely be selected,and the investment made,provided we have confidence in the data.Put another way,it is impossible to draw NPV profiles that would suggest not accepting Project X.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Project S has a pattern of high cash flows in its early life,while Project L has a longer life,with large cash flows late in its life.Neither has negative cash flows after Year 0,and at the current cost of capital,the two projects have identical NPVs.Now suppose interest rates and money costs decline.Other things held constant,this change will cause L to become preferred to S.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The primary reason that the NPV method is conceptually superior to the IRR method for evaluating mutually exclusive investments is that multiple IRRs may exist,and when that happens,we don't know which IRR is relevant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

B) The discounted payback method is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

C) The net present value method (NPV) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

D) The modified internal rate of return method (MIRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

E) The internal rate of return method (IRR) is generally regarded by academics as being the best single method for evaluating capital budgeting projects.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 107

Related Exams