B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If investors become more risk averse but rRF does not change, then the required rate of return on high-beta stocks will rise and the required return on low-beta stocks will decline, but the required return on an average-risk stock will not change.

B) An investor who holds just one stock will generally be exposed to more risk than an investor who holds a portfolio of stocks, assuming the stocks are all equally risky. Since the holder of the 1-stock portfolio is exposed to more risk, he or she can expect to earn a higher rate of return to compensate for the greater risk.

C) There is no reason to think that the slope of the yield curve would have any effect on the slope of the SML.

D) Assume that the required rate of return on the market, rM, is given and fixed at 10%. If the yield curve were upward sloping, then the Security Market Line (SML) would have a steeper slope if 1-year Treasury securities were used as the risk-free rate than if 30-year Treasury bonds were used for rRF.

E) If Mutual Fund A held equal amounts of 100 stocks, each of which had a beta of 1.0, and Mutual Fund B held equal amounts of 10 stocks with betas of 1.0, then the two mutual funds would both have betas of 1.0. Thus, they would be equally risky from an investor's standpoint, assuming the investor's only asset is one or the other of the mutual funds.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is built on historic conditions,although in most cases we use expected future data in applying it.Because betas used in the CAPM are calculated using expected future data,they are not subject to changes in future volatility.This is one of the strengths of the CAPM.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk inherent in owning stocks. Therefore, if a portfolio contained all publicly traded stocks, it would be essentially riskless.

B) The required return on a firm's common stock is, in theory, determined solely by its market risk. If the market risk is known, and if that risk is expected to remain constant, then no other information is required to specify the firm's required return.

C) Portfolio diversification reduces the variability of returns (as measured by the standard deviation) of each individual stock held in a portfolio.

D) A security's beta measures its non-diversifiable, or market, risk relative to that of an average stock.

E) A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Donald Gilmore has $100,000 invested in a 2-stock portfolio.$35,000 is invested in Stock X and the remainder is invested in Stock Y.X's beta is 1.50 and Y's beta is 0.70.What is the portfolio's beta?

A) 0.65

B) 0.72

C) 0.80

D) 0.89

E) 0.98

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Portfolio diversification reduces the variability of returns on an individual stock.

B) Risk refers to the chance that some unfavorable event will occur, and a probability distribution is completely described by a listing of the likelihood of unfavorable events.

C) The SML relates a stock's required return to its market risk. The slope and intercept of this line cannot be controlled by the firms' managers, but managers can influence their firms' positions on the line by such actions as changing the firm's capital structure or the type of assets it employs.

D) A stock with a beta of -1.0 has zero market risk if held in a 1-stock portfolio.

E) When diversifiable risk has been diversified away, the inherent risk that remains is market risk, which is constant for all stocks in the market.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock X has a beta of 0.6,while Stock Y has a beta of 1.4.Which of the following statements is CORRECT?

A) Stock Y must have a higher expected return and a higher standard deviation than Stock X.

B) If expected inflation increases but the market risk premium is unchanged, then the required return on both stocks will fall by the same amount.

C) If the market risk premium declines but expected inflation is unchanged, the required return on both stocks will decrease, but the decrease will be greater for Stock Y.

D) If expected inflation declines but the market risk premium is unchanged, then the required return on both stocks will decrease but the decrease will be greater for Stock Y.

E) A portfolio consisting of $50,000 invested in Stock X and $50,000 invested in Stock Y will have a required return that exceeds that of the overall market.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A's beta is 1.7 and Stock B's beta is 0.7.Which of the following statements must be true,assuming the CAPM is correct.

A) In equilibrium, the expected return on Stock B will be greater than that on Stock A.

B) When held in isolation, Stock A has more risk than Stock B.

C) Stock B would be a more desirable addition to a portfolio than A.

D) In equilibrium, the expected return on Stock A will be greater than that on B.

E) Stock A would be a more desirable addition to a portfolio then Stock B.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A portfolio's risk is measured by the weighted average of the standard deviations of the securities in the portfolio.It is this aspect of portfolios that allows investors to combine stocks and thus reduce the riskiness of their portfolios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks A and B each have an expected return of 15%,a standard deviation of 20%,and a beta of 1.2.The returns on the two stocks have a correlation coefficient of +0.6.Your portfolio consists of 50% A and 50% B.Which of the following statements is CORRECT?

A) The portfolio's expected return is 15%.

B) The portfolio's standard deviation is greater than 20%.

C) The portfolio's beta is greater than 1.2.

D) The portfolio's standard deviation is 20%.

E) The portfolio's beta is less than 1.2.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Diversification will normally reduce the riskiness of a portfolio of stocks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The slope of the Security Market Line is beta.

B) Any stock with a negative beta must in theory have a negative required rate of return, provided rRF is positive.

C) If a stock's beta doubles, its required rate of return must also double.

D) If a stock's returns are negatively correlated with returns on most other stocks, the stock's beta will be negative.

E) If a stock has a beta of to 1.0, its required rate of return will be unaffected by changes in the market risk premium.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are considering investing in one of the these three stocks: If you are a strict risk minimizer,you would choose Stock ____ if it is to be held in isolation and Stock ____ if it is to be held as part of a well-diversified portfolio.

A) A; B.

B) B; A.

C) C; A.

D) C; B.

E) A; A.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In historical data,we see that investments with the highest average annual returns also tend to have the highest standard deviations of annual returns.This observation supports the notion that there is a positive correlation between risk and return.Which of the following answers correctly ranks investments from highest to lowest risk (and return) ,where the security with the highest risk is shown first,the one with the lowest risk last?

A) Large-company stocks, small-company stocks, long-term corporate bonds, U.S. Treasury bills, long-term government bonds.

B) Small-company stocks, large-company stocks, long-term corporate bonds, long-term government bonds, U.S. Treasury bills.

C) U.S. Treasury bills, long-term government bonds, long-term corporate bonds, small-company stocks, large-company stocks.

D) Large-company stocks, small-company stocks, long-term corporate bonds, long-term government bonds, U.S. Treasury bills.

E) Small-company stocks, long-term corporate bonds, large-company stocks, long-term government bonds, U.S. Treasury bills.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that your cousin holds just one stock,Eastman Chemical Bonding (ECB) ,which he thinks has very little risk.You agree that the stock is relatively safe,but you want to demonstrate that his risk would be even lower if he were more diversified.You obtain the following returns data for Wilder's Creations and Buildings (WCB) .Both companies have had less variability than most other stocks over the past 5 years.Measured by the standard deviation of returns,by how much would your cousin's risk have been reduced if he had held a portfolio consisting of 60% in ECB and the remainder in WCB? (Hint: Use the sample standard deviation formula.)

A) 3.29%

B) 3.46%

C) 3.65%

D) 3.84%

E) 4.03%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Suppose the returns on two stocks are negatively correlated. One has a beta of 1.2 as determined in a regression analysis using data for the last 5 years, while the other has a beta of -0.6. The returns on the stock with the negative beta must have been negatively correlated with returns on most other stocks during that 5-year period.

B) Suppose you are managing a stock portfolio, and you have information that leads you to believe the stock market is likely to be very strong in the immediate future. That is, you are convinced that the market is about to rise sharply. You should sell your high-beta stocks and buy low-beta stocks in order to take advantage of the expected market move.

C) You think that investor sentiment is about to change, and investors are about to become more risk averse. This suggests that you should re-balance your portfolio to include more high-beta stocks.

D) If the market risk premium remains constant, but the risk-free rate declines, then the required returns on low-beta stocks will rise while those on high-beta stocks will decline.

E) Paid-in-Full Inc. is in the business of collecting past-due accounts for other companies, i.e., it is a collection agency. Paid-in-Full's revenues, profits, and stock price tend to rise during recessions. This suggests that Paid-in-Full Inc.'s beta should be quite high, say 2.0, because it does so much better than most other companies when the economy is weak.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

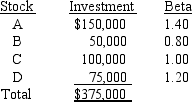

Megan Ross holds the following portfolio:  What is the portfolio's beta?

What is the portfolio's beta?

A) 1.06

B) 1.17

C) 1.29

D) 1.42

E) 1.56

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shirley Paul's 2-stock portfolio has a total value of $100,000.$37,500 is invested in Stock A with a beta of 0.75 and the remainder is invested in Stock B with a beta of 1.42.What is her portfolio's beta?

A) 1.17

B) 1.23

C) 1.29

D) 1.35

E) 1.42

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate remains constant,but the market risk premium declines.Which of the following is most likely to occur?

A) The required return on a stock with beta > 1.0 will increase.

B) The return on "the market" will remain constant.

C) The return on "the market" will increase.

D) The required return on a stock with beta < 1.0 will decline.

E) The required return on a stock with beta = 1.0 will not change.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An individual stock's diversifiable risk,which is measured by its beta,can be lowered by adding more stocks to the portfolio in which the stock is held.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 146

Related Exams