B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be most likely to lead to a decrease in a firm's dividend payout ratio?

A) Its earnings become more stable.

B) Its access to the capital markets increases.

C) Its R&D efforts pay off, and it now has more high-return investment opportunities.

D) Its accounts receivable decrease due to a change in its credit policy.

E) Its stock price has increased over the last year by a greater percentage than the increase in the broad stock market averages.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The announcement of an increase in the cash dividend should, according to MM, lead to an increase in the price of the firm's stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data apply to Grullon-Ikenberry Inc. (GII) :  The company plans on distributing $50 million as dividend payments. What will the intrinsic per share stock price be immediately after the distribution?

The company plans on distributing $50 million as dividend payments. What will the intrinsic per share stock price be immediately after the distribution?

A) $6.32

B) $6.65

C) $7.00

D) $7.35

E) $7.72

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Firm M is a mature firm in a mature industry. Its annual net income and net cash flows are both consistently high and stable. However, M's growth prospects are quite limited, so its capital budget is small relative to its net income. Firm N is a relatively new firm in a new and growing industry. Its markets and products have not stabilized, so its annual operating income fluctuates considerably. However, N has substantial growth opportunities, and its capital budget is expected to be large relative to its net income for the foreseeable future. Which of the following statements is CORRECT?

A) Firm M probably has a lower debt ratio than Firm N.

B) Firm M probably has a higher dividend payout ratio than Firm N.

C) If the corporate tax rate increases, the debt ratio of both firms is likely to decline.

D) The two firms are equally likely to pay high dividends.

E) Firm N is likely to have a clientele of shareholders who want to receive consistent, stable dividend income.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

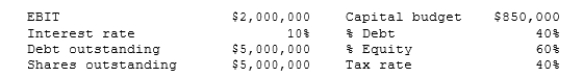

Dentaltech Inc. projects the following data for the coming year. If the firm follows the residual dividend policy and also maintains its target capital structure, what will its payout ratio be?

A) 37.2%

B) 39.1%

C) 41.2%

D) 43.3%

E) 45.5%

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the shape of the curve depicting a firm's WACC versus its debt ratio is more like a sharp "V", as opposed to a shallow "U", it will be easier for the firm to maintain a steady dividend in the face of varying investment opportunities or earnings from year to year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mortal Inc. expects to have a capital budget of $500,000 next year. The company wants to maintain a target capital structure with 30% debt and 70% equity, and its forecasted net income is $400,000. If the company follows the residual dividend policy, how much in dividends, if any, will it pay?

A) $42,869

B) $45,125

C) $47,500

D) $50,000

E) $52,500

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

One implication of the bird-in-the-hand theory of dividends is that a given reduction in dividend yield must be offset by a more than proportionate increase in growth in order to keep a firm's required return constant, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

D&P Co. has a capital budget of $2,000,000. The company wants to maintain a target capital structure that is 35% debt and 65% equity. The company forecasts that its net income this year will be $1,800,000. If the company follows a residual dividend policy, what will be its total dividend payment?

A) $100,000

B) $200,000

C) $300,000

D) $400,000

E) $500,000

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm adopts a residual distribution policy, distributions are determined as a residual after funding the capital budget. Therefore, the better the firm's investment opportunities, the lower its payout ratio should be.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Firms with a lot of good investment opportunities and a relatively small amount of cash tend to have above average payout ratios.

B) One advantage of the residual dividend policy is that it leads to a stable dividend payout, which investors like.

C) An increase in the stock price when a company decreases its dividend is consistent with signaling theory as postulated by MM.

D) If the "clientele effect" is correct, then for a company whose earnings fluctuate, a policy of paying a constant percentage of net income will probably maximize the stock price.

E) Stock repurchases make the most sense at times when a company believes its stock is undervalued.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

If investors prefer firms that retain most of their earnings, then a firm that wants to maximize its stock price should set a low payout ratio.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sheehan Corp. is forecasting an EPS of $3.00 for the coming year on its 500,000 outstanding shares of stock. Its capital budget is forecasted at $800,000, and it is committed to maintaining a $2.00 dividend per share. It finances with debt and common equity, but it wants to avoid issuing any new common stock during the coming year. Given these constraints, what percentage of the capital budget must be financed with debt?

A) 30.54%

B) 32.15%

C) 33.84%

D) 35.63%

E) 37.50%

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If management wants to maximize its stock price, and if it believes that the dividend irrelevance theory is correct, then it must adhere to the residual distribution policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a company has a 2-for-1 stock split, its stock price should roughly double.

B) Capital gains earned in a share repurchase are taxed less favorably than dividends; this explains why companies typically pay dividends and avoid share repurchases.

C) Very often, a company's stock price will rise when it announces that it plans to commence a share repurchase program. Such an announcement could lead to a stock price decline, but this does not normally happen.

D) Stock repurchases increase the number of outstanding shares.

E) The clientele effect is the best explanation for why companies tend to vary their dividend payments from quarter to quarter.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 56 of 56

Related Exams