A) 0.938

B) 0.988

C) 1.037

D) 1.089

E) 1.143

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. The portfolio's beta is 1.12. You plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.80. What will the portfolio's new beta be?

A) 1.286

B) 1.255

C) 1.224

D) 1.194

E) 1.165

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is built on historic conditions, although in most cases we use expected future data in applying it. Because betas used in the CAPM are calculated using expected future data, they are not subject to changes in future volatility. This is one of the strengths of the CAPM.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Even if the correlation between the returns on two securities is +1.0, if the securities are combined in the correct proportions, the resulting 2-asset portfolio will have less risk than either security held alone.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Generally, the SML is used to find the required return, but on occasion the required return is given and we must solve for one of the other variables. We warn our students before the test that to answer a number of the questions they will have to transform the SML equation to solve for beta, the market risk premium, the risk-free rate, or the market return. -Preston Inc.'s stock has a 25% chance of producing a 30% return, a 50% chance of producing a 12% return, and a 25% chance of producing a -18% return. What is the firm's expected rate of return?

A) 7.72%

B) 8.12%

C) 8.55%

D) 9.00%

E) 9.50%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You have the following data on (1) the average annual returns of the market for the past 5 years and (2) similar information on Stocks A and B. Which of the possible answers best describes the historical betas for A and B?

A) .

B) .

C) .

D) .

E) .

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 0.8, Stock B has a beta of 1.0, and Stock C has a beta of 1.2. Portfolio P has equal amounts invested in each of the three stocks. Each of the stocks has a standard deviation of 25%. The returns on the three stocks are independent of one another (i.e., the correlation coefficients all equal zero) . Assume that there is an increase in the market risk premium, but the risk-free rate remains unchanged. Which of the following statements is CORRECT?

A) The required return of all stocks will remain unchanged since there was no change in their betas.

B) The required return on Stock A will increase by less than the increase in the market risk premium, while the required return on Stock C will increase by more than the increase in the market risk premium.

C) The required return on the average stock will remain unchanged, but the returns of riskier stocks (such as Stock C) will increase while the returns of safer stocks (such as Stock A) will decrease.

D) The required returns on all three stocks will increase by the amount of the increase in the market risk premium.

E) The required return on the average stock will remain unchanged, but the returns on riskier stocks (such as Stock C) will decrease while the returns on safer stocks (such as Stock A) will increase.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your portfolio consists of $50,000 invested in Stock X and $50,000 invested in Stock Y. Both stocks have an expected return of 15%, betas of 1.6, and standard deviations of 30%. The returns of the two stocks are independent, so the correlation coefficient between them, rXY, is zero. Which of the following statements best describes the characteristics of your 2-stock portfolio?

A) Your portfolio has a standard deviation of 30%, and its expected return is 15%.

B) Your portfolio has a standard deviation less than 30%, and its beta is greater than 1.6.

C) Your portfolio has a beta equal to 1.6, and its expected return is 15%.

D) Your portfolio has a beta greater than 1.6, and its expected return is greater than 15%.

E) Your portfolio has a standard deviation greater than 30% and a beta equal to 1.6.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) When diversifiable risk has been diversified away, the inherent risk that remains is market risk, which is constant for all stocks in the market.

B) Portfolio diversification reduces the variability of returns on an individual stock.

C) Risk refers to the chance that some unfavorable event will occur, and a probability distribution is completely described by a listing of the likelihoods of unfavorable events.

D) The SML relates a stock's required return to its market risk. The slope and intercept of this line cannot be controlled by the firms' managers, but managers can influence their firms' positions on the line by such actions as changing the firm's capital structure or the type of assets it employs.

E) A stock with a beta of -1.0 has zero market risk if held in a 1- stock portfolio.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you manage a $10.00 million mutual fund that has a beta of 1.05 and a 9.50% required return. The risk-free rate is 4.20%. You now receive another $5.00 million, which you invest in stocks with an average beta of 0.65. What is the required rate of return on the new portfolio? (Hint: You must first find the market risk premium, then find the new portfolio beta.)

A) 8.83%

B) 9.05%

C) 9.27%

D) 9.51%

E) 9.74%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A stock with a beta equal to -1.0 has zero systematic (or market) risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things held constant, if the expected inflation rate decreases and investors also become more risk averse, the Security Market Line would be affected as follows:

A) The y-axis intercept would decline, and the slope would increase.

B) The x-axis intercept would decline, and the slope would increase.

C) The y-axis intercept would increase, and the slope would decline.

D) The SML would be affected only if betas changed.

E) Both the y-axis intercept and the slope would increase, leading to higher required returns.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wei Inc. is considering a capital budgeting project that has an expected return of 25% and a standard deviation of 30%. What is the project's coefficient of variation?

A) 1.20

B) 1.26

C) 1.32

D) 1.39

E) 1.46

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

"Risk aversion" implies that investors require higher expected returns on riskier than on less risky securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Assume that two investors each hold a portfolio, and that portfolio is their only asset. Investor A's portfolio has a beta of minus 2.0, while Investor B's portfolio has a beta of plus 2.0. Assuming that the unsystematic risks of the stocks in the two portfolios are the same, then the two investors face the same amount of risk. However, the holders of either portfolio could lower their risks, and by exactly the same amount, by adding some "normal" stocks with beta = 1.0.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For markets to be in equilibrium, that is, for there to be no strong pressure for prices to depart from their current levels,

A) The expected rate of return must be equal to the required rate of return; that is, rˆ = r.

B) The past realized rate of return must be equal to the expected future rate of return; that is, r = rˆ .

C) The required rate of return must equal the past realized rate of return; that is, r = r .

D) All three of the above statements must hold for equilibrium to exist; that is rˆ = r = r .

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

Company A has a beta of 0.70, while Company B's beta is 1.20. The required return on the stock market is 11.00%, and the risk-free rate is 4.25%. What is the difference between A's and B's required rates of return? (Hint: First find the market risk premium, then find the required returns on the stocks.)

A) 2.75%

B) 2.89%

C) 3.05%

D) 3.21%

E) 3.38%

G) B) and D)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

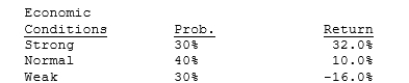

Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns? (Hint: Use the formula for the standard deviation of a population, not a sample.)

A) 17.69%

B) 18.62%

C) 19.55%

D) 20.52%

E) 21.55%

G) A) and E)

Correct Answer

verified

B

Correct Answer

verified

True/False

Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events, and their effects on investment risk can in theory be diversified away.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

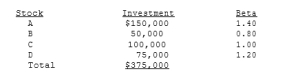

Bruce Niendorf holds the following portfolio:  Bruce plans to sell Stock A and replace it with Stock E, which has a beta of 0.75. By how much will the portfolio beta change?

Bruce plans to sell Stock A and replace it with Stock E, which has a beta of 0.75. By how much will the portfolio beta change?

A) -0.190

B) -0.211

C) -0.234

D) -0.260

E) -0.286

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 137

Related Exams