A) The portfolio's beta is less than 1.2.

B) The portfolio's expected return is 15%.

C) The portfolio's standard deviation is greater than 20%.

D) The portfolio's beta is greater than 1.2.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A stock's beta measures its diversifiable (or company-specific) risk relative to the diversifiable risks of other firms.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If a company with a high-beta stock merges with a low-beta company, the best estimate of the new merged company's beta is 1.0.

B) The beta of an "average stock," or "the market," can change over time, sometimes drastically.

C) If a newly issued stock does not have a past history that can be used as a basis for calculating beta, then we should always estimate that its beta will turn out to be 1.0. This is especially true if the company finances with more debt than the average firm.

D) During a period when a company is undergoing a change such as increasing its use of leverage or taking on riskier projects, the calculated historical beta may be drastically different than the "true" or "expected future" beta.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has an expected return of 12.60%. Its beta is 1.49 and the risk-free rate is 5.00%. What is the market risk premium?

A) 5.10%

B) 5.23%

C) 5.36%

D) 5.49%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate remains constant, but the market risk premium declines. Which of the following is most likely to occur?

A) The required return on a stock with beta > 1.0 will increase.

B) The return on the market will remain constant.

C) The return on the market will increase.

D) The required return on a stock with beta < 1.0 will decline.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A stock's beta is more relevant as a measure of risk to an investor who holds only one stock than to an investor who holds a well-diversified portfolio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

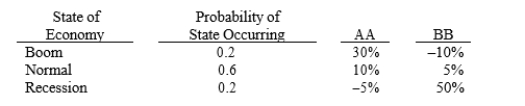

The distributions of rates of return for Companies AA and BB are given below:  We can conclude from the above information that any rational risk-averse investor will add Security

AA to a well-diversified portfolio over Security BB.

We can conclude from the above information that any rational risk-averse investor will add Security

AA to a well-diversified portfolio over Security BB.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Portfolio A has but one security, while Portfolio B has 100 securities. Because of diversification effects, we would expect Portfolio B to have the lower risk. However, it is possible for Portfolio A to be less risky.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Variance is a measure of the variability of returns, and since it involves squaring the deviation of each actual return from the expected return, it is always larger than its square root, its standard deviation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that in recent years both expected inflation and the market risk premium (rM - rRF) have declined. Assume also that all stocks have positive betas. Which of the following would be most likely to have occurred as a result of these changes?

A) The required returns on all stocks have fallen, but the decline has been greater for stocks with lower betas.

B) The required returns on all stocks have fallen, but the fall has been greater for stocks with higher betas.

C) Required returns have increased for stocks with betas greater than 1.0 but have declined for stocks with betas less than 1.0.

D) The required returns on all stocks have fallen by the same amount.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

J. Harper Inc.'s stock has a 50% chance of producing a 35% return, a 30% chance of producing a 10% return, and a 20% chance of producing a -28% return. What is Harper's expected return?

A) 14.16%

B) 14.53%

C) 14.90%

D) 15.27%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

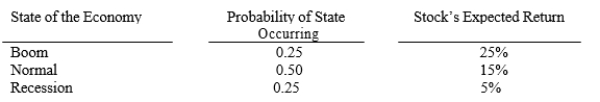

Ripken Iron Works believes the following probability distribution exists for its stock. What is the coefficient of variation on the company's stock?

A) 0.4360

B) 0.4714

C) 0.5068

D) 0.5448

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If you plotted the returns of a given stock against those of the market, and if you found that the slope of the regression line was NEGATIVE, the CAPM would indicate that the required rate of return on the stock should be greater than the risk-free rate for a well-diversified investor, assuming that the observed relationship is expected to continue into the future.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently, the risk-free rate is 6% and the market risk premium is 5%. Given this information, which of the following statements is correct?

A) An index fund with beta = 1.0 should have a required return of 11%.

B) An index fund with beta = 1.0 should have a required return less than 11%.

C) If a stock's beta doubles, its required return must also double.

D) An index fund with beta = 1.0 should have a required return greater than 11%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the risk-free rate is 5%. Which of the following statements is correct?

A) If a stock has a negative beta, its required return under the CAPM would be less than 5%.

B) If a stock's beta doubled, its required return under the CAPM would also double.

C) If a stock's beta were less than 1.0, its required return under the CAPM would less than 5%.

D) If a stock's beta were 1.0, its required return under the CAPM would be 5%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yonan Corporation's stock had a required return of 11.50% last year, when the risk-free rate was 5.50% and the market risk premium was 4.75%. Now suppose there is a shift in investor risk aversion, and the market risk premium increases by 2%. The risk-free rate and Yonan's beta remain unchanged. What is Yonan's new required return? (Hint: First calculate the beta, then find the required return.)

A) 14.03%

B) 14.38%

C) 14.74%

D) 15.10%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mutual fund manager has a $20 million portfolio with a beta of 1.00. The risk-free rate is 4.25%, and the market risk premium is 6.00%. The manager expects to receive an additional $25.50 million, which she plans to invest in additional stocks. After investing the additional funds, she wants the fund's required and expected return to be 13.00%. What must the average beta of the new stocks be to achieve the target required rate of return?

A) 1.73

B) 1.82

C) 1.91

D) 2.00

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stock A has a beta of 1.2 and a standard deviation of 25%. Stock B has a beta of 1.4 and a standard deviation of 20%. Portfolio AB was created by investing in a combination of Stocks A and B. Portfolio AB has a beta of 1.25 and a standard deviation of 18%. Which of the following statements is correct?

A) Stock A has more market risk than Portfolio AB.

B) Stock A has more market risk than Stock B but less stand-alone risk.

C) Portfolio AB has more money invested in Stock A than in stock B.

D) Portfolio AB has the same amount of money invested in each of the two stocks.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If a company's beta doubles, then its required rate of return will also double.

B) Other things held constant, if investors suddenly became convinced that there would be deflation in the economy, then the required returns on all stocks should increase.

C) If a company's beta were cut in half, then its required rate of return would also be halved.

D) If the risk-free rate rises by 0.5% but the market risk premium declines by that same amount, then the required rates of return on an average stock will remain unchanged, but required returns on stocks with betas less than 1.0 will rise.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The CAPM is built on historic conditions, although in most cases we use expected future data in applying it. Because betas used in the CAPM are calculated using expected future data, they are not subject to changes in future volatility. This is one of the strengths of the CAPM.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 137

Related Exams